Daily Outlook Monday 20th July 2015

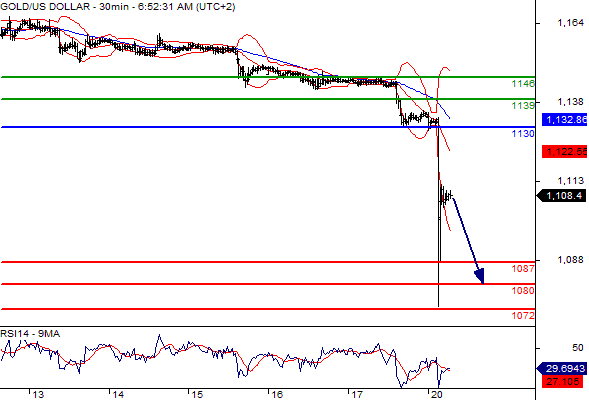

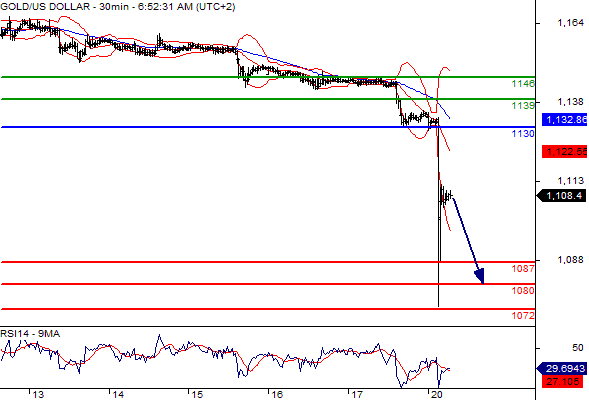

Big story overnight: GOLD dropped more than 60 dollars in a few minutes. That’s a 5% move and is an extremely rare phenomenon.

Gold has now reached a 5 year low.

Reason for the move: no more Grexit fears + China has announced it has bought much smaller amounts than what people had expected.

If you would have sold 100 ounces of GOLD, risking just $500 on Friday, you could have made a total profit of $6.000

Trading quote of the day: “Successful investing is anticipating the anticipations of others.” – John Maynard Keynes

Green lines are resistance, Red lines are support

Currency Updates:

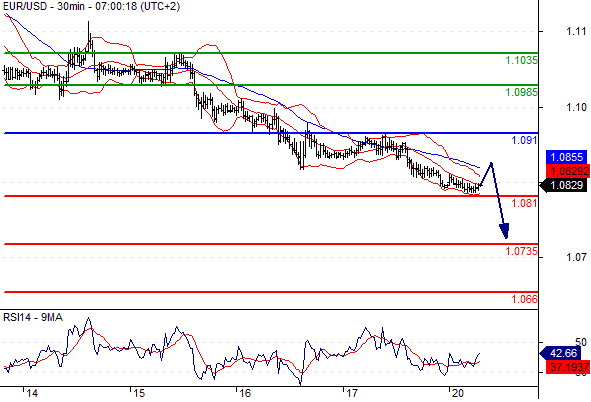

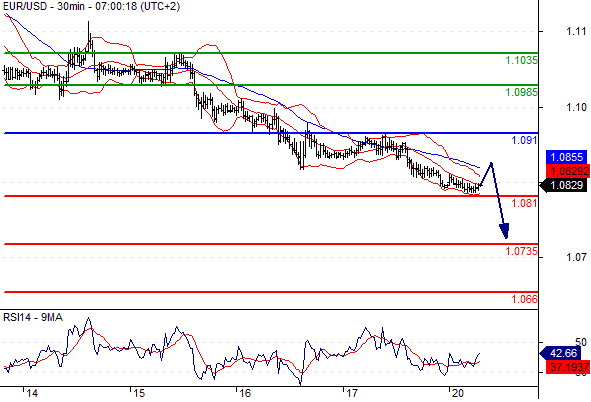

EURUSD

Pivot: 1.091

Likely scenario: Short positions below 1.091 with targets @ 1.081 & 1.0735 in extension.

Alternative scenario: Above 1.091 look for further upside with 1.0985 & 1.1035 as targets.

Comment: A break below 1.081 would trigger a drop towards 1.0735.

USDJPY

Pivot: 123.9

Likely scenario: Long positions above 123.9 with targets @ 124.35 & 124.6 in extension.

Alternative scenario: Below 123.9 look for further downside with 123.7 & 123.35 as targets.

Comment: The RSI is supported by a rising trend line.

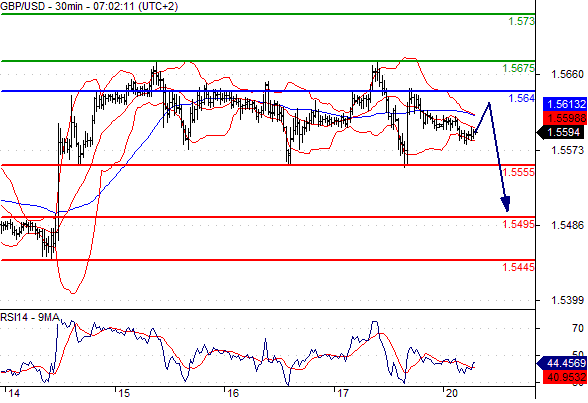

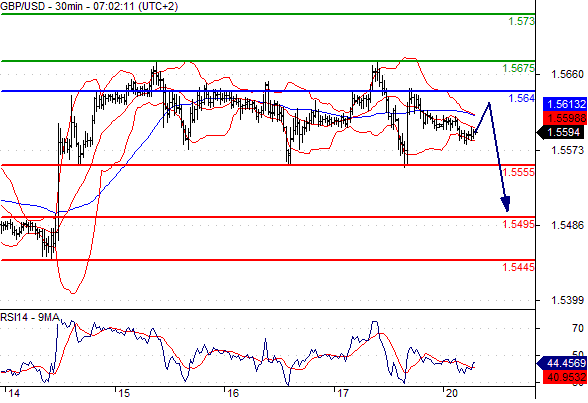

GBPUSD

Pivot: 1.564

Likely scenario: Short positions below 1.564 with targets @ 1.5555 & 1.5495 in extension.

Alternative scenario: Above 1.564 look for further upside with 1.5675 & 1.573 as targets.

Comment: The RSI is bearish and calls for further downside.

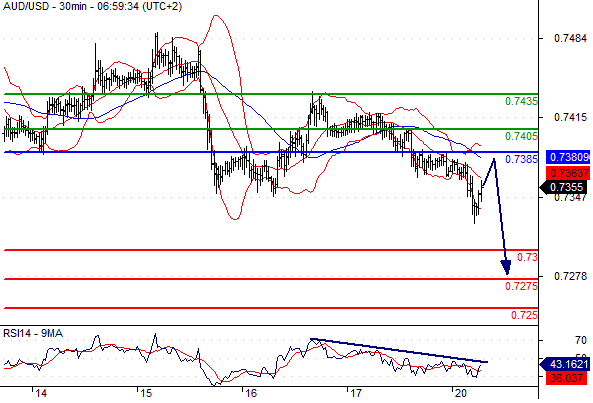

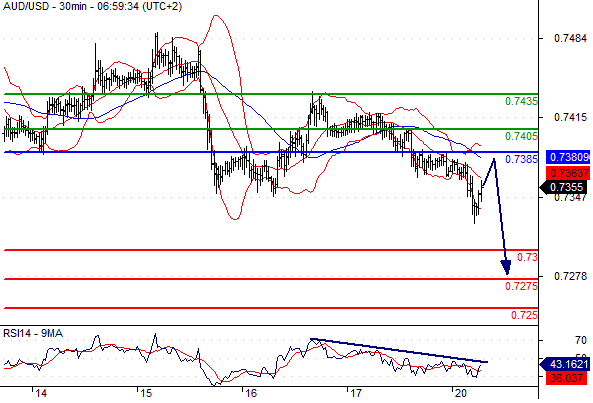

AUDUSD

Pivot: 0.7385

Likely scenario: Short positions below 0.7385 with targets @ 0.73 & 0.7275 in extension.

Alternative scenario: Above 0.7385 look for further upside with 0.7405 & 0.7435 as targets.

Comment: The RSI is capped by a declining trend line.

GOLD

Pivot: 1130

Likely scenario: Short positions below 1130 with targets @ 1087 & 1080 in extension.

Alternative scenario: Above 1130 look for further upside with 1139 & 1146 as targets.

Comment: As long as 1130 is resistance, likely decline to 1087.

USDCAD

Pivot: 1.2945

Likely scenario: Long positions above 1.2945 with targets @ 1.301 & 1.3045 in extension.

Alternative scenario: Below 1.2945 look for further downside with 1.29 & 1.281 as targets.

Comment: The RSI is mixed to bullish.

USDCHF

Pivot: 0.955

Likely scenario: Long positions above 0.955 with targets @ 0.9635 & 0.967 in extension.

Alternative scenario: Below 0.955 look for further downside with 0.9505 & 0.9475 as targets.

Comment: The RSI is bullish and calls for further advance.

OIL

Pivot: 51.25

Likely scenario: Short positions below 51.25 with targets @ 50 & 49.3 in extension.

Alternative scenario: Above 51.25 look for further upside with 52.2 & 52.85 as targets.

Comment: As long as 51.25 is resistance, likely decline to 50.

DAX

Pivot: 11475

Likely scenario: Long positions above 11475 with targets @ 11800 & 11900 in extension.

Alternative scenario: Below 11475 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is mixed to bullish.