Daily Outlook Wednesday 22th July 2015

Markets are mixed today with the USD showing weakness against EUR but stability versus GBP. Commodity currencies managed to recover from their lows despite the fact that GOLD dropped from 1106 to 1093 overnight. The catalyst for the slide was the revision of the US industrial sector, which came much lower than what was expected, putting a break on hopes that the FED can begin raising rates as soon as September. Profit taking, as well as fears for Grexit subsiding, are also responsible for the USD selloff.

In Australia, AUDUSD dipped as RBA Governor Stevens kept the door open for further rate cuts. AUDUSD dropped to 0.7370 but managed to recover to 0.7415 at time of writing.

Indices had a tough day, as earnings misses from names such as Apple, Yahoo, and Microsoft were responsible for the US stock markets closing in the Red and Dow losing the 18,000 point mark again. Weakness was transferred over to Asia with all major Stocks suffering Losses. European session is also expected to open lower.

Noteworthy news for today are the Bank of England Minutes as well as the Housing Data out of the US. Last week Housing Data was a catalyst for a USD rally so keep an eye on that. Later tonight, RBNZ (New Zealand Central Bank) decides on interest rates.

Trading quote of the day: “The most important organ in the body as far as the stock market is concerned is the guts, not the head. Anyone can acquire the know-how for analyzing stocks.” – Peter Lynch

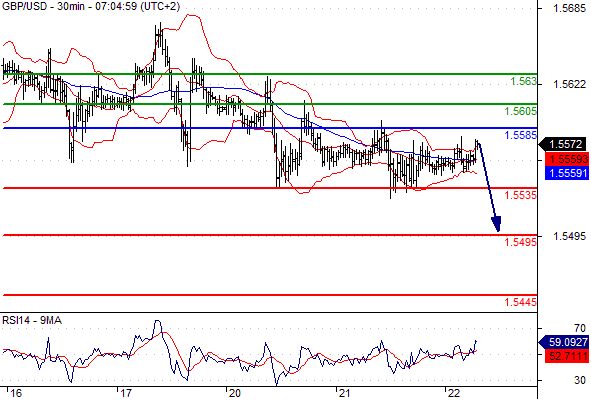

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.3

Likely scenario: Short positions below 1.3 with targets @ 1.29 & 1.281 in extension.

Alternative scenario: Above 1.3 look for further upside with 1.3045 & 1.309 as targets.

Comment: As long as 1.3 is resistance, look for choppy price action with a bearish bias.

USDCHF

Pivot: 0.962

Likely scenario: Short positions below 0.962 with targets @ 0.955 & 0.9505 in extension.

Alternative scenario: Above 0.962 look for further upside with 0.965 & 0.968 as targets.

Comment: As long as 0.962 is resistance, look for choppy price action with a bearish bias.

OIL

Pivot: 51.6

Likely scenario: Short positions below 51.6 with targets @ 49.7 & 49 in extension.

Alternative scenario: Above 51.6 look for further upside with 52.5 & 53.3 as targets.

Comment: As long as 51.6 is resistance, likely decline to 49.7.

DAX

Pivot: 11475

Likely scenario: Long positions above 11475 with targets @ 11720 & 11800 in extension.

Alternative scenario: Below 11475 look for further downside with 11250 & 11150 as targets.

Comment: The RSI has just landed on a support around 30% and is reversing up.