Daily Outlook Thursday 23rd July 2015

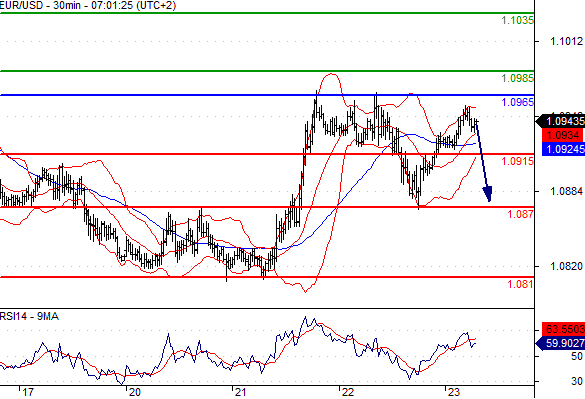

Greece’s Government managed to pass the key reform measures necessary for starting the negotiations for the new 86 billion EURO bailout, but the news did not have any impact on EURUSD.

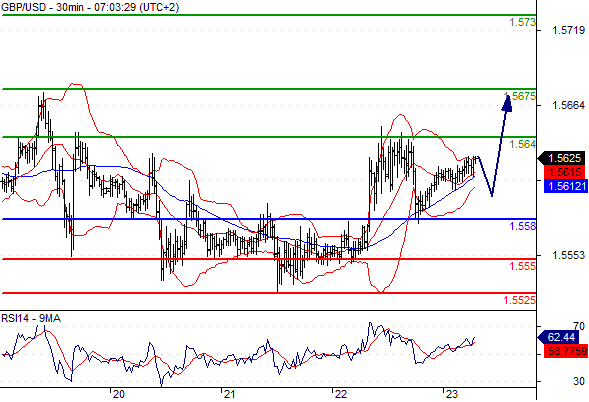

GBPUSD lost some ground after the release of Bank of England minutes that revealed a hawkish stance of some of its members. Key data out of UK today are Retail Sales which are expected to show a small decline compared to earlier month.

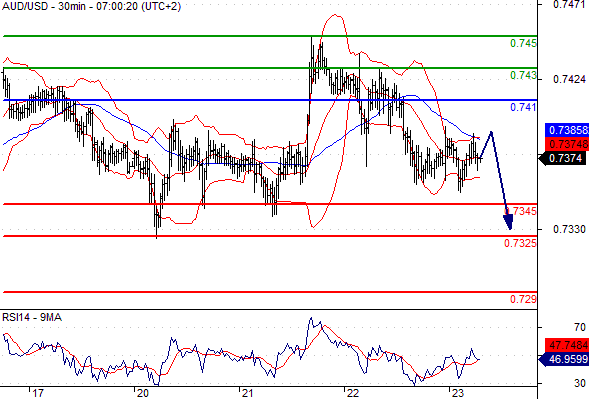

Crude oil made a new low at 49.05 after an unexpected increase in US oil supplies. The drop also affected oil exporting currencies such as the USDCAD which posted a new 6 year high at 1.3050.

NZDUSD strengthened following the widely expected rate cut from the nation’s Central Bank. This was the second rate cut in 6 weeks.

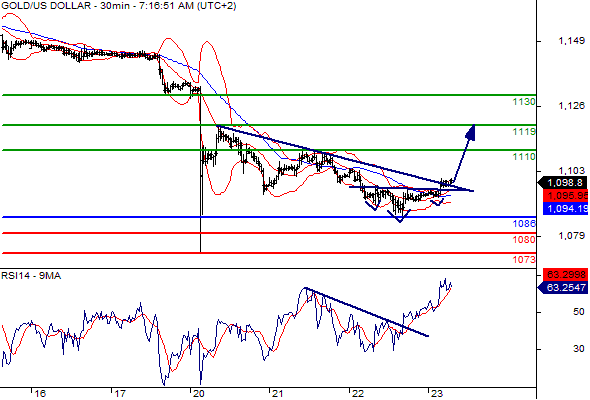

GOLD was once again under pressure yesterday and posted new lows at 1086. The metal is under pressure and further drop cannot be excluded.

Today the economic Calendar includes the release of US Initial Jobless claims and Canadian Retail Sales. As mentioned, UK will also release the June Retail Sales.

Trading Quote of the Day: “The Road to Success is Always under Construction”

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.3

Likely scenario: Long positions above 1.3 with targets @ 1.3055 & 1.309 in extension.

Alternative scenario: Below 1.3 look for further downside with 1.2965 & 1.29 as targets.

Comment: Technically the RSI is above its neutrality area at 50.

USDCHF

Pivot: 0.956

Likely scenario: Long positions above 0.956 with targets @ 0.9625 & 0.965 in extension.

Alternative scenario: Below 0.956 look for further downside with 0.954 & 0.9505 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

OIL

Pivot: 50.6

Likely scenario: Short positions below 50.6 with targets @ 48.5 & 48 in extension.

Alternative scenario: Above 50.6 look for further upside with 51.6 & 52.5 as targets.

Comment: As long as 50.6 is resistance, likely decline to 48.5.

DAX

Pivot: 11475

Our preference: Long positions above 11475 with targets @ 11720 & 11800 in extension.

Alternative scenario: Below 11475 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is bullish and calls for further upside.