This week we have catalysts that could potentially provide ample trading opportunities, especially in AUD, CNH & USD.

In terms of economic calendar, I would like to highlights the following releases:(Times are in Sydney AEST; Perth, Singapore are 3 hours behind; please see full calendar at easy forex website):

Tuesday 1st March

- 11:30 AUD Building Approvals

- 12:00 CNH Manufacturing PMI

- 14:30 AUD Reserve Bank of Australia Rate Decision Market pricing a 6% chance of RBA cutting rates, focus will be on the statement.

Wednesday 2nd March

- 02:00 USD ISM Manufacturing PMI

- 11:30 AUD GDP

Thursday 3rd March

- 00:15 USD ADP Non-Farm Employment Change

- 11:30 AUD Trade Balance

Friday 4th March

- 02:00 USD ISM Non-Manufacturing PMI

- 11:30 AUD Retail Sales

Saturday 5th March

- 00:30 USD Avg Hourly Earnings & Non-Farm Employment Change

Options Strategy Examples

Please note this is not a recommendation to trade. If you would like further information on one or more of the below ideas please call the dealing room on 1800 176 935 prior to placing a trade.

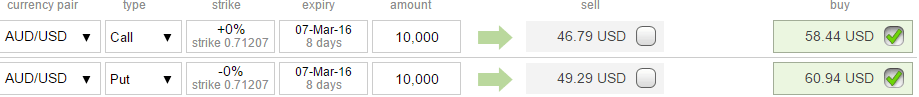

Buy Call and Put for a Straddle Position on AUD/USD; AUD has a number of significant data set to be released as above, offering the potential of increased volatility.

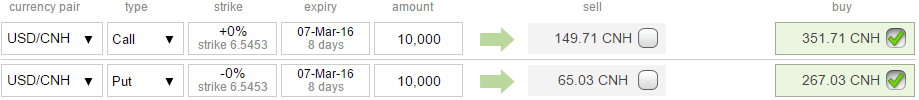

Buy Call and Put Option for a Straddle Position on USD/CNH; concern over China’s growth rates dominated headlines at the beginning of this year. Eyes will remain on China’s Manufacturing PMI this week as worse than expected data could see significant price movements.

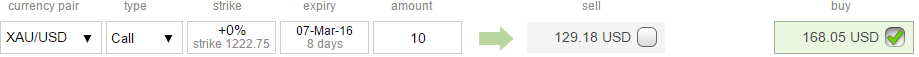

Buy Call Option for Long Gold Exposure; Gold continues to show signs of a major structural shift, with its impressive recovery from its low of 1046 in late 2015. The precious metal shows strong demand on dips with investors looking for alternative investment in a negative rate environment and hedging against uncertainty.

Please note that this does not represent a trade recommendation and no individual needs or circumstances have been considered.

Important note: These technical and research reports are provided to easyMarkets® as a subscriber of third party providers. They are provided for informative purposes only and in no way can they be considered as a recommendation by easyMarkets® to you to engage in any trade. Hence, easyMarkets® shall not be held responsible for any outcome of trading decisions, in regards with these reports or similar reports. You hereby acknowledge that using the information entailed in these reports is at your sole responsibility and you will have no claims with regards to these reports against easyMarkets®. If you do not agree to this, you are strongly advised not to use these reports.

easyMarkets Pty Ltd (AFSL 246566 ABN 73107184510) makes no recommendations as to the merits of any financial product referred to in this website, emails or its related websites and the information contained does not take into account your personal objectives, financial situation and needs. easyMarkets recommends that you read the Regulation Page, The Product Disclosure Statement, the Terms and Conditions and the Financial Services Guide before making any decision concerning easyMarkets’ products