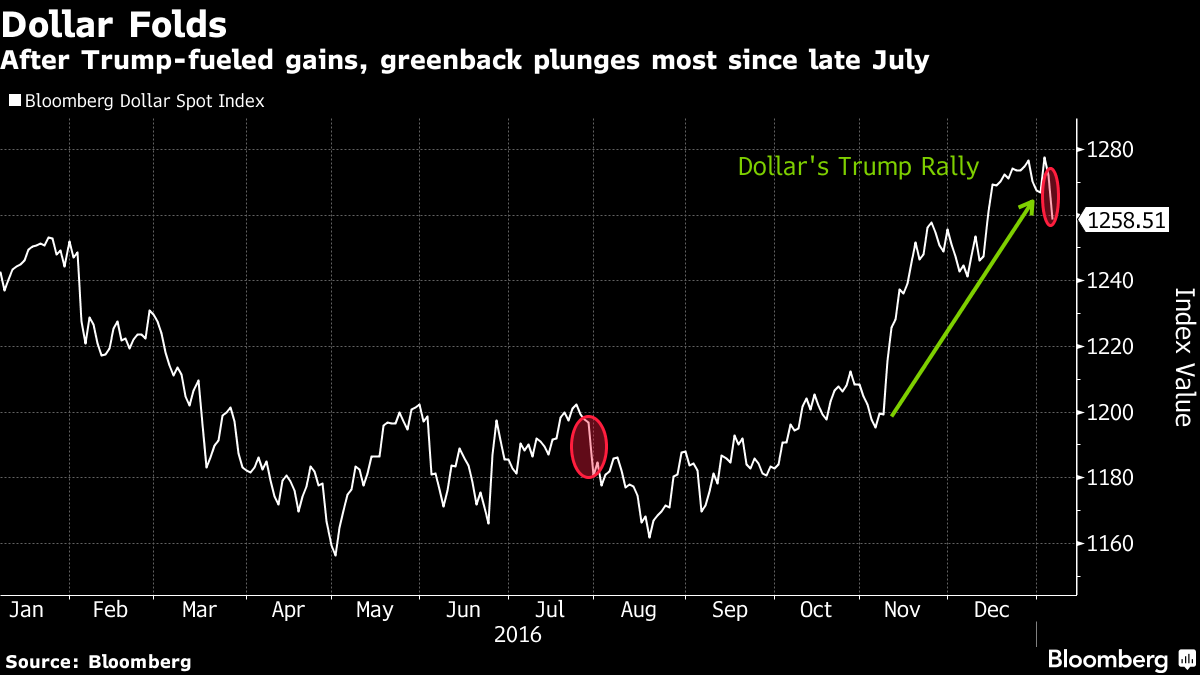

The greenbacks two month rally against the yen came to an abrupt end on Thursday as the currency fell 1.5% to 115.49. Despite a better than expected decline in jobless claims and an uptick in services data, the decline was fueled by improving economic data from China and Europe juxtaposed with U.S. figures that seem to indicate a softening in the anticipated preliminary Non-Farm payroll report.

The situation was compounded by the the Chinese central bank tightening liquidity in Hong Kong. The PBOC instructed the nation’s banks to withhold funds from other banks, a move that drove the yuan in offshore trading to its highest level since early November. As a result, the rate that banks charge each other in Hong Kong’s overnight lending market leapt from 17% to 38%, the highest in a year.

The yuan soared 1.2% on Thursday to 6.7883 against the U.S. dollar as the PBOC sought to punish traders placing one way bets against the currency. The currency has strengthened 2.5% over the past two sessions.

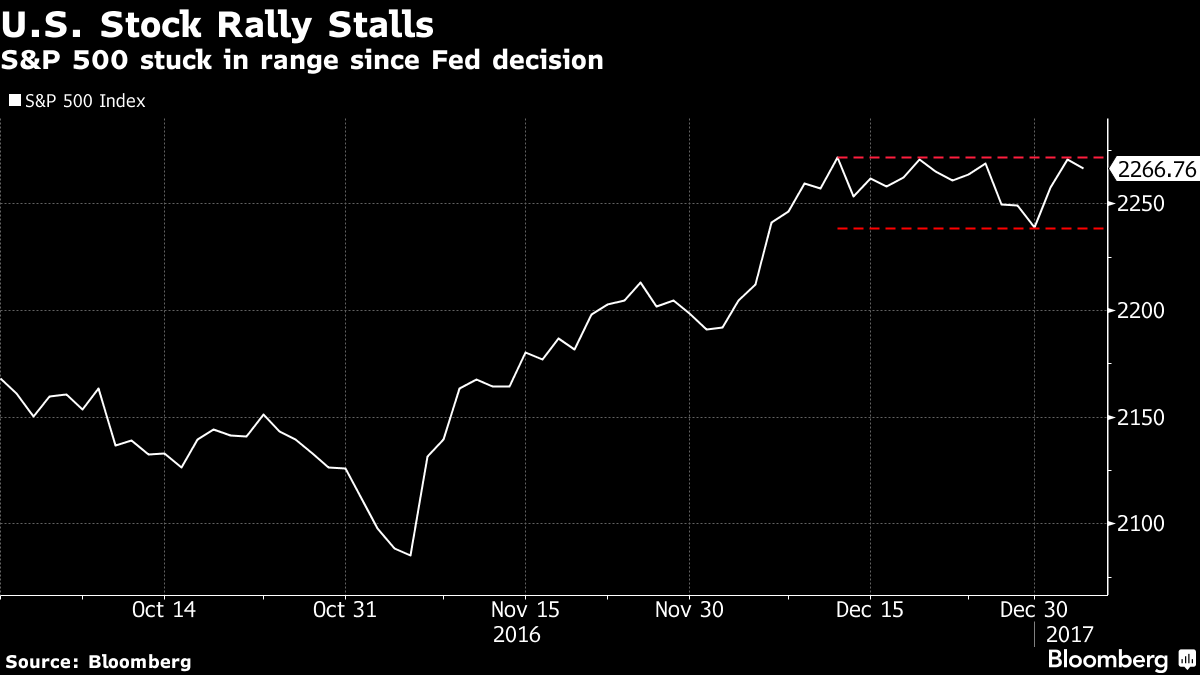

The PBOC’s action rippled through global markets causing traders to rethink the Trump trade. The Dow dropped 43 points to 19899 and the yield on the 10-year U.S. Treasury note slid below its level prior to the Fed’s December rate increase falling 0.08 percentage points to 2.37%. Meanwhile emerging-market shares erased post-election losses and gold reached a four week high rising 1.5 percent to its highest level in almost a month at $1,181 an ounce. Silver and platinum also rose in the spot market while Palladium slipped after rallying 11 percent in the previous four sessions.

In energy, light, sweet crude for February delivery gained 0.9% or 50 cents to $53.76 a barrel on the New York Mercantile Exchange, after trading as low as $52.79 earlier in the session. While Brent, the global benchmark, settled up 0.8% or 43 cents to $56.89 a barrel. Prices were supported by news that Saudi Arabia, the world’s largest exporter, has cut its production by the agreed 486,000 barrels a day, according to a person familiar with the kingdom’s output.

Additionally, for the first time, OPEC has set up a monitoring committee to check production output. The group is reportedly holding a two-day meeting Jan. 21-22 to assess the compliance situation.

Upcoming Events

Data Front:

Nonfarm Payrolls Report (13:30 PM GMT),

International Trade (13:30 PM GMT),

Factory Orders (15:00 PM GMT),

Baker-Hughes Rig Count (18:00 PM GMT).

Fedspeak:

Chicago Fed’s Charles Evans (16:15 PM GMT),

Richmond Fed’s Jeffrey Lacker Speaks (18:00 PM GMT),

Dallas Fed’s Robert Kaplan Speaks (20:30 PM GMT).

If you have any feedback on the daily outlook or you have any suggestions as to how to improve it (topics of interest etc.), please email us at Pacific@easymarkets.com