U.S. oil prices broke down below $50 for the first time this since November 29. WTI for April delivery settled down 2% or $1 to $49.28 a barrel on the New York Mercantile Exchange. It has lost 7.6% in the last few days. Brent crude, the global benchmark, lost 1.7% or 92 cents to $52.19 a barrel on ICE Futures Europe. It has lost 6.8% in a three-session losing streak, its biggest losses in three sessions since last summer. Concerns are mounting that OPEC’s output cuts are failing to restrain record U.S. stockpiles, with the post-agreement oil rally evaporating.

Additionally, in recent weeks traders have posted a record number of bets on oil prices moving higher. The surprise increase in U.S. stockpiles have now forced some of them to rethink that bet. Any further bad news would result in money mangers rethinking their positions and leading to a cascade of selling that forces prices lower.

In currencies, the Euro rose to 1.0615 against the greenback after the ECB left policy unchanged as expected. The QE schedule and easing bias remains intact. In his press conference afterwards, European Central Bank President Mario Draghi said that further measures to support the eurozone’s economic recovery and boost inflation are becoming less likely.

The Australian Dollar continued it’s downward trend reaching a new two month low overnight at 0.7490 against the greenback on the back of further positive data from the U.S.

Meanwhile the British Pound found support at 1.2140 and the Yen slipped to 114.94.

We expect a quiet Asian trading session since all eyes are on tonight Non-Farm Payroll report which will be a key factor in the Federal Reserves decision to raise rates next week.

Gold prices retreated to a one-month low on Thursday as traders geared up for an imminent rise in interest rates.

Gold for April delivery settled down 0.5% at $1,203.20 a troy ounce on the Comex division of the New York Mercantile Exchange, its eighth consecutive sessions of losses and its longest losing streak since May 2016. Prices closed at the lowest level since Jan. 30.

Meanwhile, copper fell for the fourth day in a row and settled down 0.8% at $2.5800 a pound, closing at a two-month low. Copper has been weighed down on doubts of economic demand from China, the world’s largest consumer of the metal. While Chinese factory prices rose at the fastest pace since 2008 in February, consumer price inflation came in below expectations on Thursday.

In soft commodities, Soybean prices slid to a two-month low after figures were released by the USDA’s monthly supply-and-demand report which predicted a Brazilian soybean crop this year of 108 million metric tons, up from the 104 million tons projected in February and almost double the expected increase. Soybean futures for May delivery fell 10 3/4 cents, or 1.1%, to $10.11 a bushel at the Chicago Board of Trade. It’s lowest close since Jan 6.

Corn also tumbled 5 1/4 cents, or 1.4%, to $3.67 a bushel on the USDA’s forecast for Brazil’s corn harvest, rising to 91.5 million metric tons from 86.5 million in February, outpacing the Brazilian government’s estimates which were released earlier Thursday. Corn production estimates for Argentina’s corn crop also rose.

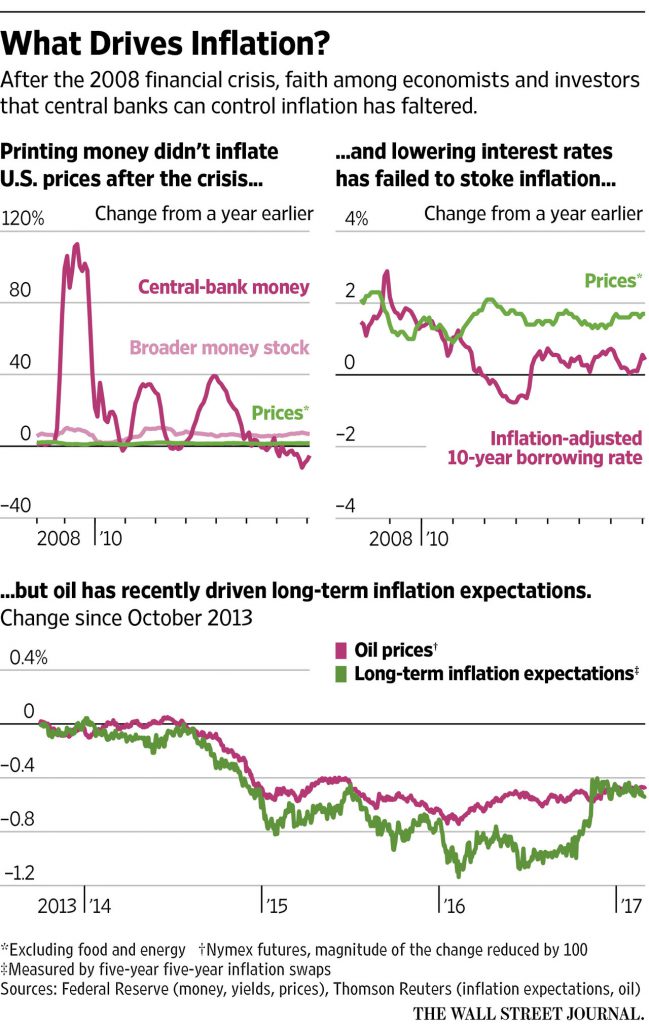

Chart of the Day.