This week starts slow as we have UK and US away on Holidays and the initial moves suggest we will need to wait till Tuesday for action.

That being said the lack of reaction to negative Trump headlines and N.Korea testing another ballistic missile over the weekend suggests the USD is on a strong footing and USD/JPY is grinding higher along with EUR/USD grinding lower in the Asian Session so far.

Later in the week we get a lot of PMI data around the world and remember this has been showing great strength especially in Europe.

We finish the week with US Jobs NFP data and this as always going to be a key market mover. Perhaps more so this month because if the FED is looking for another excuse to delay raising on the 14th June then it will be a weak number in combination with the weak CPI we already got April.

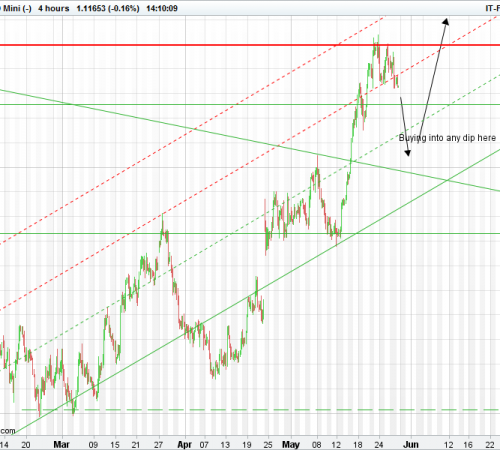

EUR/USD

The EUR/USD long story whilst still in play is starting to mature and the price action last week looks like fatigue and this opens the door to a corrective pullback towards 1.1000 that will be a good buying opportunity before June 8 ECB meeting.

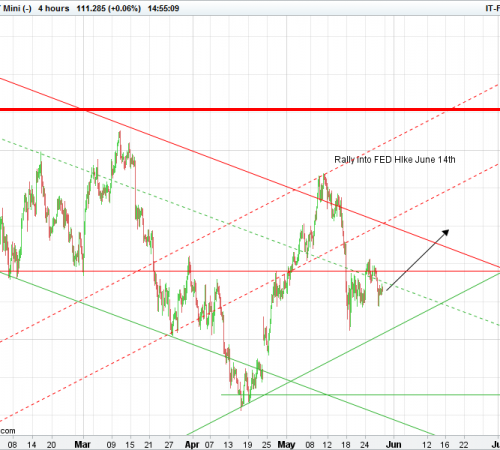

USD/JPY

USD/JPY is finding tentative support and is actually underperforming the US stock market and Yields and this disconnect could allow a bigger relief rally if the market focus on US economic strength and FOMC rather than trump. The most telling bullish signal is negative news like the N.Korea test having little to small effect.

Regards

TonyD