ETHEREUM TRADING

EVERYTHING YOU NEED TO KNOW ABOUT TRADING ETHEREUM CFDs THE easyMarkets WAY

What is Ethereum (ETH)

Ethereum was created to address some of the transactional weaknesses of Bitcoin. Whereas Bitcoin is a great holder of value, Ethereum is an improved blockchain that offers transaction speed, as well as some automated smarts called “smart contracts” or contract triggers.

Ethereum has some real world financial capability that supports two parties being able to transact without a middle man, but what Ethereum does that is better than Bitcoin, is that it allows such transactions to occur automatically, or against specific rules.

So for example, if you entered into an Ethereum smart contract, you could have arranged to be paid automatically when a trigger even occurs. This allows rules to be setup around automated payments, negating the need for a middle-man process to manage the payment. Such smart contracts have enormous application in the real world in removing transactional delays that occur in current financial processes.

What is the difference between trading Ethereum CFDs and buying Ethereum?

There are two main ways to buy and trade Ethereum:

- Using traditional exchanges, you can buy Ethereum in the hope of selling it at a profit. Depositing into exchanges is notoriously difficult with deposit methods being difficult and cumbersome. The buying process is also complex, and requires you to buy Ethereum coins at market value, and you only make a profit when you sell and someone else buys your coin from you. In a falling market, this strategy may fail if you can't sell your coins.

- Trading with easyMarkets CFDs allows you to purchase an Ethereum market position at market value, without actually owning the coin. Instead of having to sell your coin to make a profit, you can simply close your position effective immediately. A buyer of your coin is not required, and you can walk away with your profits in seconds, rather than waiting for a buyer to purchase.

How leveraged Ethereum trading works

Ethereum contracts for difference (CFDs) give you access to the Ethereum market price without you having to purchase any Ethereum. This trading method provides an alternative way of trading because you don’t hold any actual Ethereum and also means you don’t need to use a wallet to store them.

Ethereum is mostly quoted against the USD, so when you buy Ethereum on an exchange, you are selling USD and buying Ethereum. If the Ethereum price rises, you could sell it for a profit, however if Ethereum's price falls, then you end up making a loss on the trade if you close your position.

When you trade Ethereum with easyMarkets CFD's, instead of taking ownership of Ethereum, you’re opening a position that can increase in value as Ethereum's price increases against the USD.

You can use CFD's to open short and long positions, to take advantage of rising or falling markets. Ethereum can be traded on our easyMarkets trading platforms, as well as on Metatrader 4 (MT4).

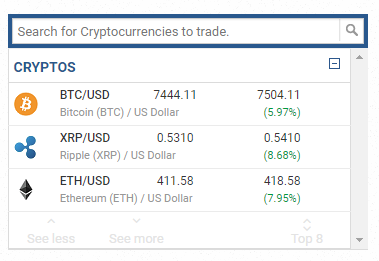

Cryptocurrency Trading Plaform

What's the difference between Bitcoin and Ethereum?

Similar to Bitcoin, Ethereum is a publicly distributed blockchain network.

Although there are some substantial similarities between Bitcoin and Ethereum, the most important noted distinction is that Bitcoin and Ethereum differ substantially in purpose and capability and are driven by different processes.

Bitcoin offers a specific type of blockchain technology called a 'peer to peer' electronic cash system which enables online transfer of payments.

Blockchain technology has been used to create applications which go beyond just supporting cryprocurrency transactions. These new applications like Ethereum are sometimes referred to as blockchain 2.0 or crypto 2.0.

Launched in 2015, Ethereum is the largest and most established open ended decentralised software platform that supports smart contracts and distributed applications. It is clearly more than just a cryprocurrency that includes its own programming language.

Whilst both Bitcoin and Ethereum are powered by distributed ledgers, Ethereum is an expanded version of Bitcoin that support additional automated functionality and a wider commercial application.

Ethereum is mostly quoted against the USD, so when you buy Ethereum on an exchange, you are selling USD and buying Ethereum. If the Ethereum price rises, you could sell it for a profit, however if Ethereum's price falls, then you end up making a loss on the trade if you close your position.

When you trade Ethereum with easyMarkets CFD's, instead of taking ownership of Ethereum, you’re opening a position that can increase in value as Ethereum's price increases against the USD.

You can use CFD's to open short and long positions, to take advantage of rising or falling markets. Ethereum can be traded on our easyMarkets trading platforms, as well as on Metatrader 4 (MT4).

Open A Trading Account Now

There's no minimum balance to open an account, it takes minutes to create, and there's no obligation to fund or trade. Open an account to experience our platform and trading features.

Live Ethereum Price Chart

Use the live interactive Ethereum price chart below to view the market and consider your trading opportunities and strategy. Use the chart drawing tools to place support and resistance lines on the chart to determine trading parameters.

Why trade Ethereum with easyMarkets?

Trade Long Or Short Positions

Unlike other cryptocurrency exchanges, you can make money in both a falling and rising market by trading cryptocurrency CFDs.

Top Tier Banks

Your funds remain safe and secure in top tier, low credit risk, global banks. Only you can access your funds.

Segregated Funds

To protect client deposits, all client funds are separate to easyMarkets company funds and are not available to be used for easyMarkets operating purposes.

Capital Adequacy

We maintain sufficient liquid capital to cover all client deposits, potential fluctuations in the company’s currency positions and outstanding expenses.

No Wallets Needed

Unlike cryptocurrency exchanges that have a history of being hacked, your funds are safe in our accounts with no complicated wallet storage procedures or risk of being hacked.

Deposit & Withdrawals

An online cashier to make account funding easy, straight forward and without complicated procedures.

Regulation and Security

easyMarkets is regulated by ASIC. We offer our clients negative balance protection and their funds are held in segregated accounts.

Unique risk management with easyMarkets

Open A Trading Account Now

There's no minimum balance to open an account, it takes minutes to create, and there's no obligation to fund or trade. Open an account to experience our platform and trading features.

easyMarkets Ethereum Trading

easyMarkets opened up forex trading to the retail market making it accessible to anyone with an internet connection. Now they’re doing it again by simplifying Ethereum trading so you can access the most exciting asset in the market today.

24/5 Support

Our team is ready to answer your questions and help you get started.

Safety

Since 2001, trader safety has been at the core of everything we do.

Trade Anywhere

Trade on mobile, tablet or PC with superior platform execution.

Market Insights

Our market experts will help you understand this new & exciting asset.

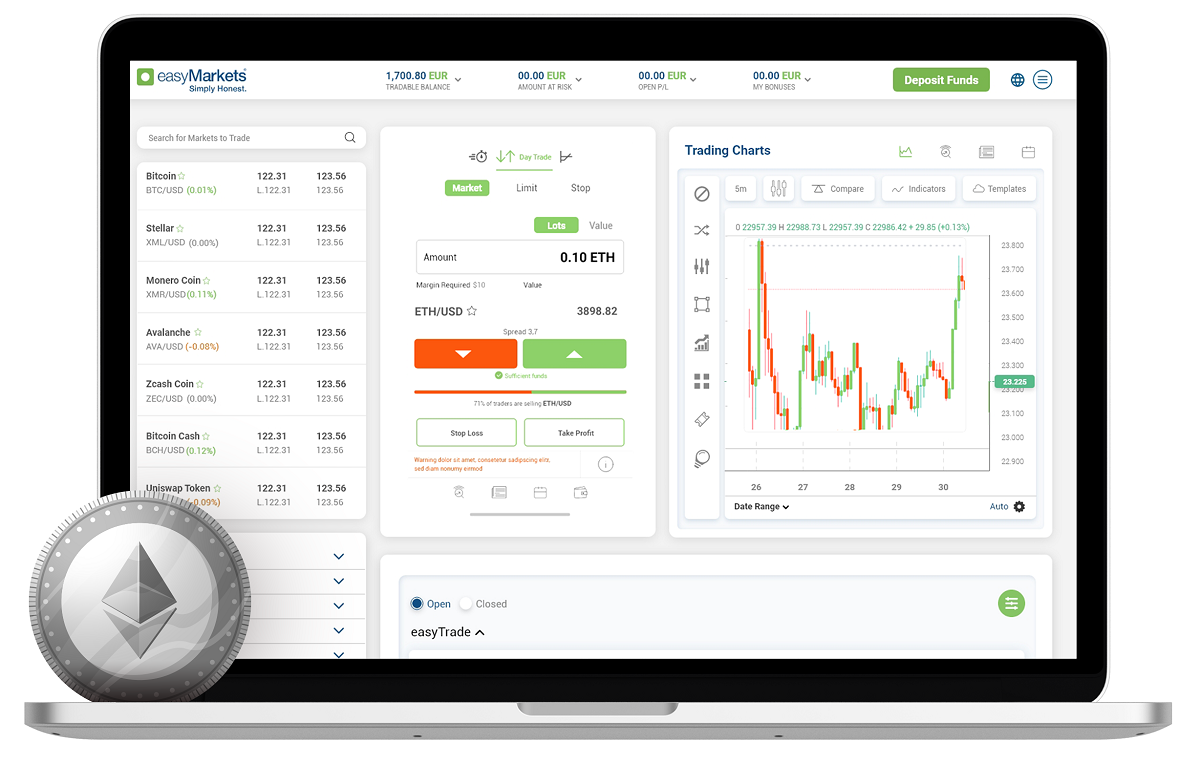

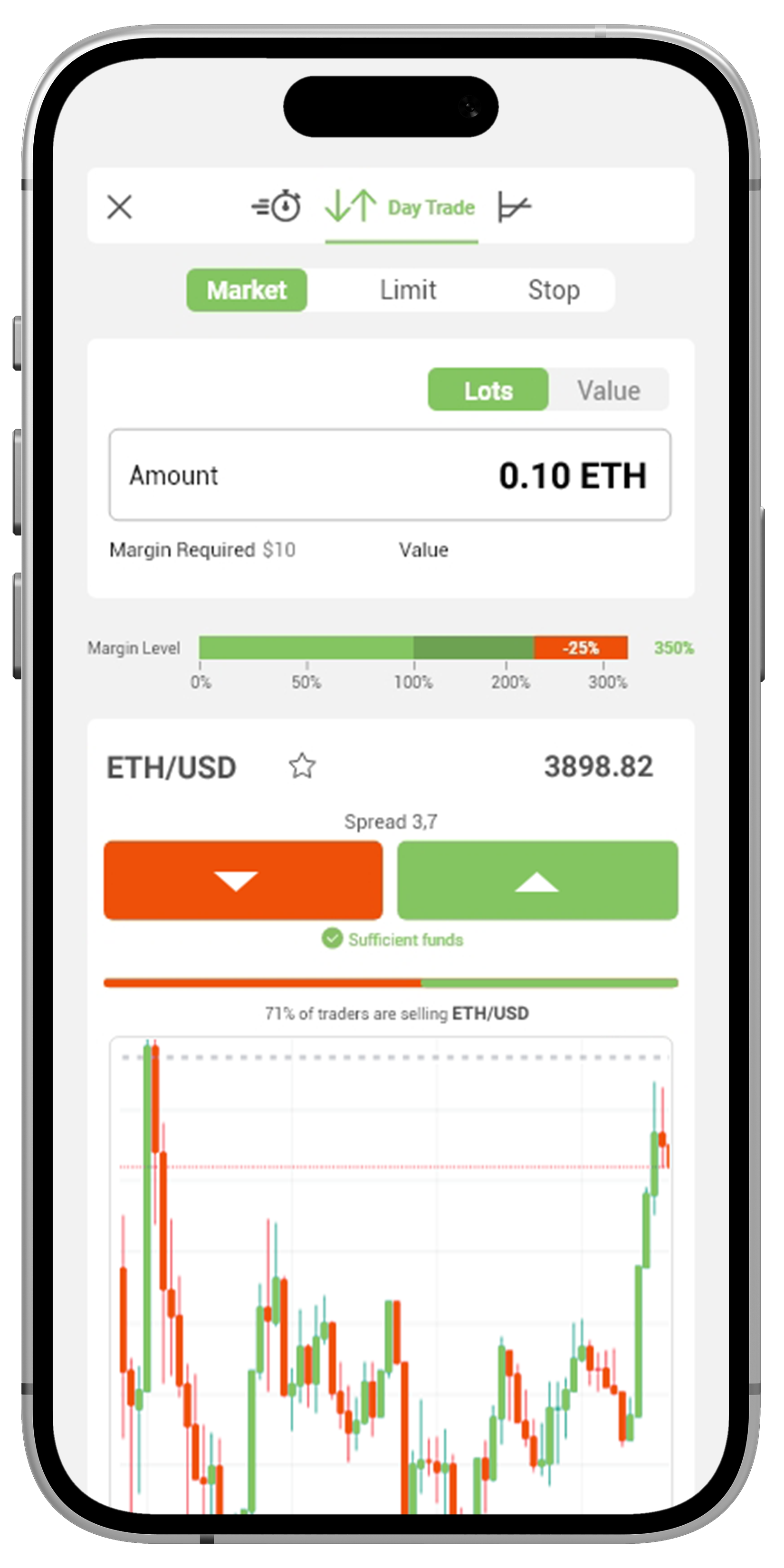

Trade Cryptocurrencies Multiple Ways

easyMarkets Platform

Our web trading platform features fixed spreads, zero slippage and an extremely user-friendly interface. New traders will find it easy to navigate and experienced clients will find all the tools they need.

Android or iOS

Access markets anywhere with an internet connect on any Android and iOS device. It features the same great tools and usability as our web platform with the option to set up price notifications when the app isn’t open, so you are never caught by surprise.

easyMarkets MT4

MT4 offers analysis and automated trading tools like chart overlays, price alerts and EAs. Now you can combine easyMarkets trading conditions – like fixed spreads – with the tools available on MT4.

easyMarkets MT5

MT5 brings you an enhanced trading experience with multi-asset support, more powerful charting features and advanced trading functionalities.

TradingView

TradingView provides a cutting-edge charting platform, real-time market data, and a community of trading insights. Now you can combine easyMarkets’ transparent trading conditions, like fixed spreads, with the powerful charting and analysis tools available on TradingView.

Frequently Asked Questions

Not at all. With easyMarkets you are simply speculating on the price movement of Ethereum ($). You never actually need to purchase any Ethereum, which means you're never exposed to your Ethereum being stolen or hacked from within an unregulated exchange.

There are many factors that determine safety when trading and we try our best to support a safe trading environment. We can confirm that your capital wont be stolen or hacked such as cases with unregulated exchanges that have been hacked and Ethereum stolen. When trading with easyMarkets, your funds are held in segregated accounts separate to company funds that only you can access.

Yes. We offer Ethereum trading across all our platforms as well as MT4.

Open A Trading Account Now

There's no minimum balance to open an account, it takes minutes to create, and there's no obligation to fund or trade. Open an account to experience our platform and trading features.

What our Traders say about us

Offering our clients an exceptional customer experience since 2003

Reviews on

Best APAC Region Broker 2018

ADVFN International Financial Awards

easyMarkets is honored to be the recipient of the panel judged

ADVFN Best APAC Broker award

Australian Regulated

AFSL 246566

easyMarkets Pty Ltd (AFSL 246566 ABN 73107184510) makes no recommendations as to the merits of any financial product referred to in this website, emails or its related websites and the information contained does not take into account your personal objectives, financial situation and needs. We recommends that you read the Regulation Page, The Product Disclosure Statement, the Terms and Conditions and the Financial Services Guide before making any decision concerning easyMarkets products.

2018 © easyMarkets Pty Ltd (formerly known as easy forex Pty Ltd) ABN 73 107 184 510 and is regulated by the Australian Securities and Investments Commission (ASIC). Australian Financial Service (AFS) License No. 246566.

easyMarkets Pty is part of Blue Capital Markets Group (Blue Capital Markets Ltd is not regulated by the AFSL and ASIC).