Daily Outlook Wednesday 15th July 2015

US retail sales disappointed yesterday, falling 0.3% vs positive 0.3% expectation. USD was sold off initially but has recovered well since.

US equities continue to climb up, driven by outperformance in technology stocks (US Tech +0.7%). It is close to approaching and all-time high however, whether it will breakout or reverse is dependent on the strength of companies’ earnings coming up for the rest of the week.

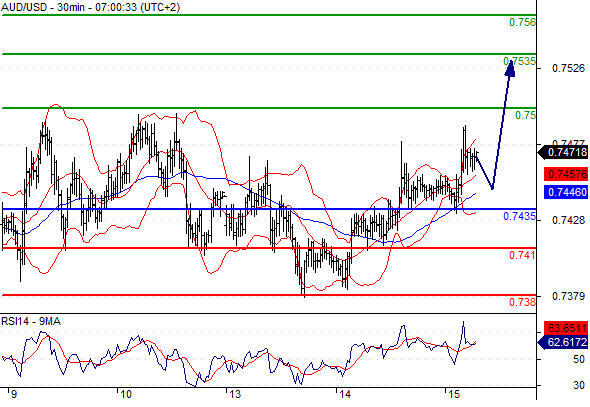

China’s June quarter GDP was released at 7% annual pace growth, beating the forecast of 6.9%. China’s industrial production, retail sales and urban fixed asset investment were also all above expectation. This has lend a boost to the Aussie dollar. Despite the beat, 7% marks the equal lowest level of growth seen since March quarter of 2009.

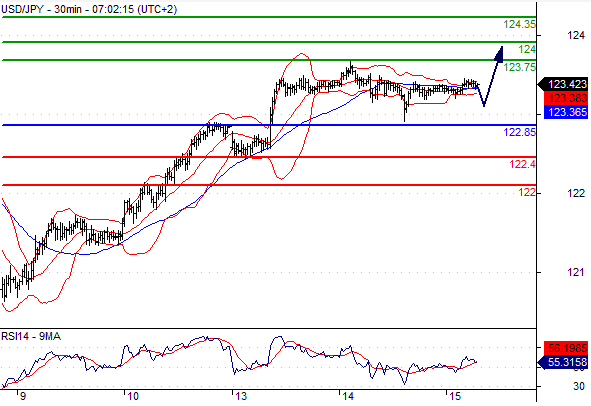

Bank of Japan maintains their monetary policy steady at 80 trillion JPY (647 billion USD at 123.5 USDJPY) annual rise in monetary base. BoJ stated the economy continues to recover moderately but has slightly lowered its views on exports and outlook.

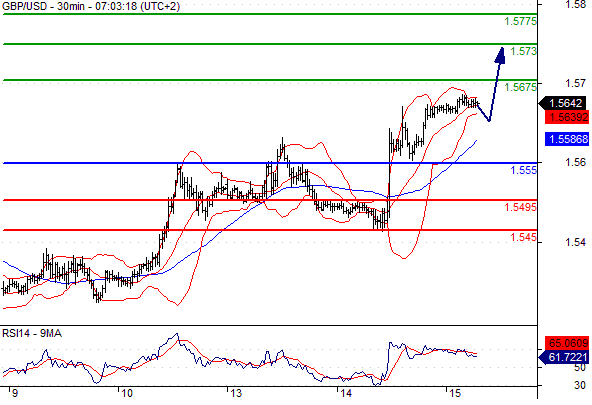

Today look out for average earnings and claimant count from the UK at 08:30GMT, PPI from the US at 12:30GMT followed by Bank of Canada overnight rate announcement at 14:00GMT. Janet Yellen also testifies at the same time.

Trading Quote the Day: “I love mistakes. I love problems. Because I think all of that is part of the process .” Ray Dalio, founder of world’s biggest hedge fund.

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.272

Likely scenario: Long positions above 1.272 with targets @ 1.2765 & 1.281 in extension.

Alternative scenario: Below 1.272 look for further downside with 1.269 & 1.265 as targets.

Comment: A support base at 1.272 has formed and has allowed for a temporary stabilisation.

USDCHF

Pivot: 0.949

Likely scenario: Short positions below 0.949 with targets @ 0.9395 & 0.9365 in extension.

Alternative scenario: Above 0.949 look for further upside with 0.953 & 0.957 as targets.

Comment: As long as the resistance at 0.949 is not surpassed, the risk of the break below 0.9395 remains high.

OIL

Pivot: 52.1

Likely scenario: Long positions above 52.1 with targets @ 53.85 & 54.45 in extension.

Alternative scenario: Below 52.1 look for further downside with 51.43 & 50.9 as targets.

Comment: The RSI is mixed to bullish.

DAX

Pivot: 11650

Likely scenario: Short positions below 11650 with targets @ 11420 & 11250 in extension.

Alternative scenario: Above 11650 look for further upside with 11800 & 11900 as targets.

Comment: The upward potential is likely to be limited by the resistance at 11650.