Daily Outlook Thursday 16th July 2015

US Fed Yellen reiterated that rate a hike is appropriate at some point this year if the economy evolves as expected. This is based on projections on the anticipated path of the economy, not statements of intent to raise rates at any particular time. Jeffrey Gundlach, a bond fund manager, said the Fed won’t hike this year as economic data will not continue to improve. US data has been inconsistent at best.

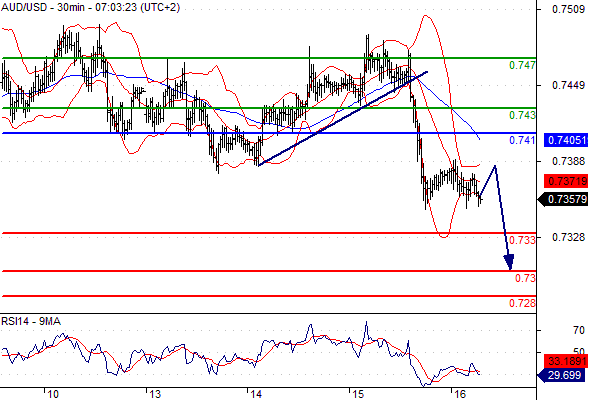

Commodities linked currencies (AUD, CAD, NZD) have been sold off past 24 hours. Bank of Canada announced a rate cut to 0.5% from 0.75% yesterday and lowered their 2015 GDP outlook to 1.1% from 1.9% resulting in a new 6 year high for the USDCAD. Weaker than forecast New Zealand CPI, 6 year lows of Global Dairy Trade auction prices and Fonterra (NZ’s largest exporter) announcing job cuts have led to NZD underperformance (-1.9% low). Analysts from banks (Westpac, Barclays, AMP, BNZ etc) have called the RBNZ to cut rates at least 3 times this year, with Westpac forecasting 4 rate cuts to 2% from 3.25% in 2015.

In regards to the AUD, darker outlook of CAD and NZD have weighed in AUD’s sentiment; Australia is in an extended period of below trend GDP growth with mining sector in a downturn and Australia’s terms of trade (exports minus imports) continue in downward pressure especially to China.

As expected, Greece parliament approved Eurogroup proposed bailout plan. Today, we have Eurozone inflation report along with ECB meeting presenting risk for the EUR. Later from the US we also have jobless claims report.

Global equities remain supported since Greece’s deal announcement and Chinese stocks stabilisation.

Trading Quote of the Day: “I’m really a ten on a scale of one-to-ten bullish on Indian equities for the next generation,” – Jeffrey Gundlach

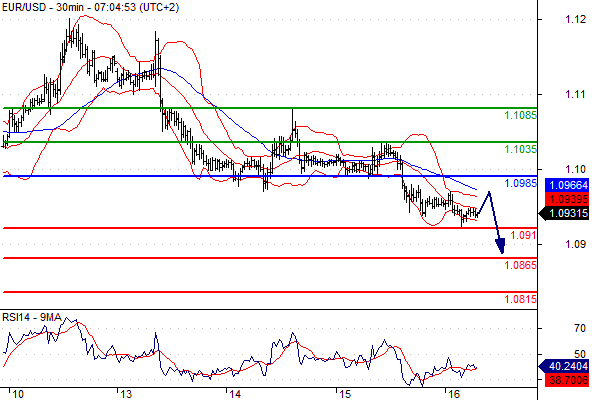

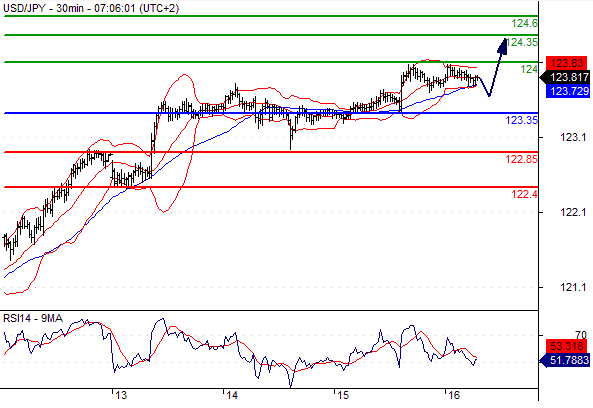

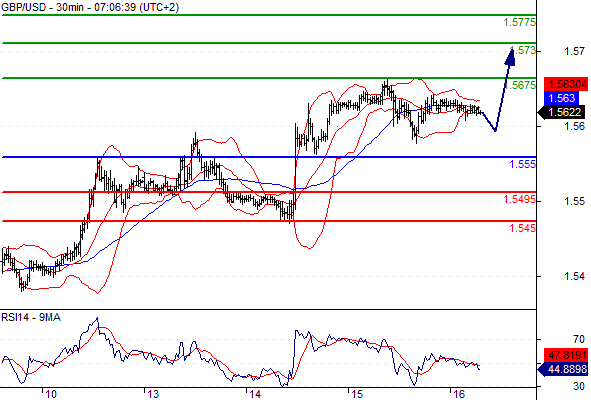

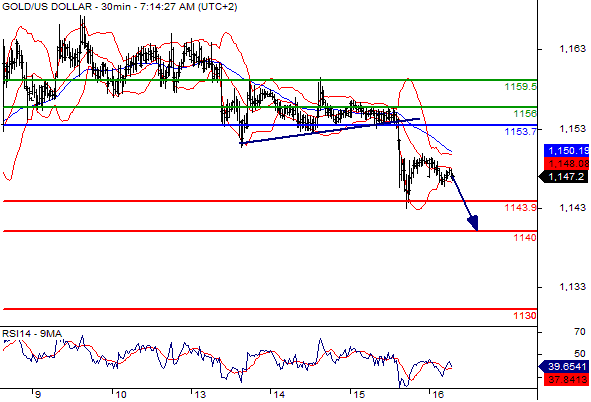

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.281

Likely scenario: Long positions above 1.281 with targets @ 1.298 & 1.3045 in extension.

Alternative scenario: Below 1.281 look for further downside with 1.277 & 1.272 as targets.

Comment: Technically the RSI is above its neutrality area at 50.

USDCHF

Pivot: 0.9475

Likely scenario: Long positions above 0.9475 with targets @ 0.957 & 0.96 in extension.

Alternative scenario: Below 0.9475 look for further downside with 0.944 & 0.9395 as targets.

Comment: The RSI is well directed.

OIL

Pivot: 53

Likely scenario: Short positions below 53 with targets @ 50.9 & 50.55 in extension.

Alternative scenario: Above 53 look for further upside with 53.85 & 54.45 as targets.

Comment: As long as 53 is resistance, likely decline to 50.9.

DAX

Pivot: 11420

Likely scenario: Long positions above 11420 with targets @ 11800 & 11900 in extension.

Alternative scenario: Below 11420 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is bullish and calls for further upside.