Daily Outlook Friday 17th July 2015

Global equities remain bid with outperformance from US Tech / NASDAQ (+1.5%) breaking to record highs. Earnings from Netflix (+18%) and Google (13% after hours) buoyed the market.

The USD index is hovering around the two months high following US Fed Yellen restating that the Fed is on course to lift rates this year. US inflation data and building permits are due out 12:30 GMT and likely to guide USD sentiment into the weekend.

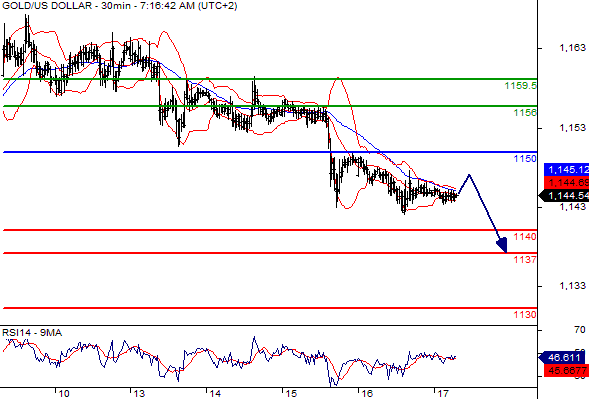

Gold is losing its shine this week as it is testing the 2015 low around 1142. Volatility has been low and how the market will react if it tests the 1131 multi-year low will be interesting.

WTI Oil has been consolidating between 50.80 and 53.50 in a textbook range bound market following the sell off from 62.

What did we learn this week?

- What Grexit?

- Yellen signalling rate hike in 2015

- Strong US companies Q2 earnings

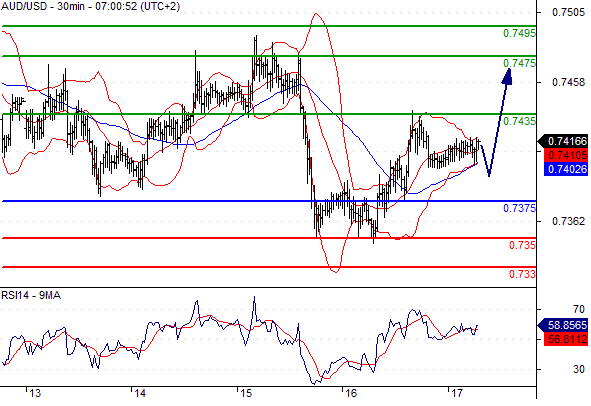

- Commodities linked currencies (including AUD, NZD, CAD) are fragile

Trading Quote of the Day: “The truth of the matter is that you always know the right thing to do. The hard part is doing it.” – General Norman Schwarzkopf

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.29

Likely scenario: Long positions above 1.29 with targets @ 1.298 & 1.3045 in extension.

Alternative scenario: Below 1.29 look for further downside with 1.281 & 1.277 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

USDCHF

Pivot: 0.9505

Likely scenario: Long positions above 0.9505 with targets @ 0.96 & 0.9635 in extension.

Alternative scenario: Below 0.9505 look for further downside with 0.9475 & 0.944 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

OIL

Pivot: 52.2

Likely scenario: Short positions below 52.2 with targets @ 50.55 & 50 in extension.

Alternative scenario: Above 52.2 look for further upside with 52.87 & 53.4 as targets.

Comment: As long as 52.2 is resistance, likely decline to 50.55.

DAX

Pivot: 11475

Likely scenario: Long positions above 11475 with targets @ 11800 & 11900 in extension.

Alternative scenario: Below 11475 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is mixed to bullish.