Daily Outlook Friday 24th July 2015

USD recovered some significant ground versus most currencies and commodities helped by solid job data. Initial jobless claims dropped to 255k versus expectation of 275k. In the UK, Retail Sales were terrible. -0.2% versus expectation of 0.3% resulting in a 170 pip move lower to 1.5500 from 1.5670.

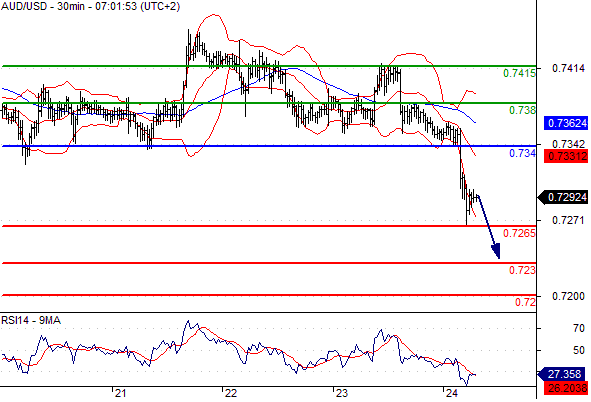

The biggest mover today in Asia was the AUDUSD. Falling commodity prices and a possible FED rate hike caused the selloff which is also attributed to the weak PMI report out of China. As a result, and due to the fact that Australia is also a gold exporter, GOLD fell over $10 to around $1080.

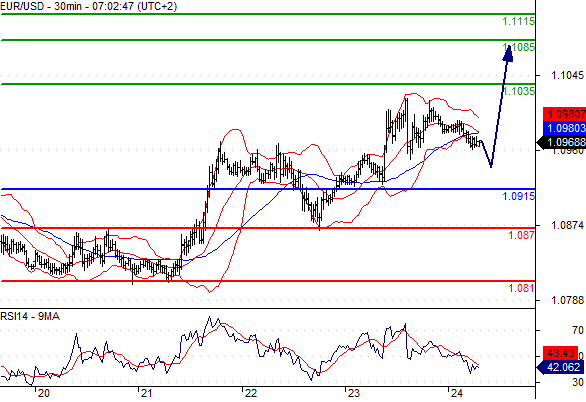

EURUSD remains more or less unchanged and trades near 1.0970 in a tight range of 30 pips. OIL is also lower following the commodity selloff and traded as low as 48.64.

Economic releases today are dominated by a number of PMI releases in the euro area which are expected to show a small decline from elevated levels. In the US we have new home sales release and July manufacturing PMI. After a series of better-than-expected data out of the US – illustrated yesterday by the lowest jobless claims figure since 1973– the releases today will likely show a solid US recovery with housing picking up and consumption growing decently.

Trading Quote of the day: “It’s better to lose your opinion, than to lose your money”

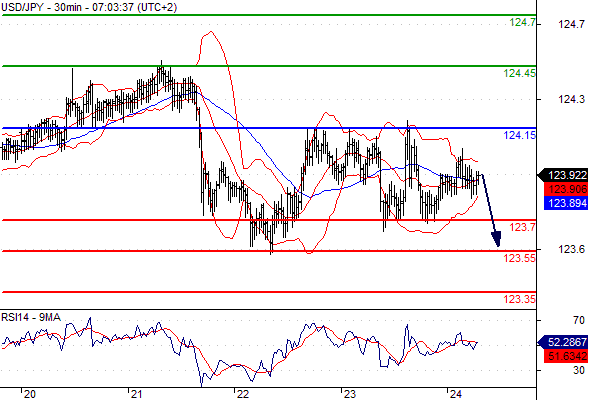

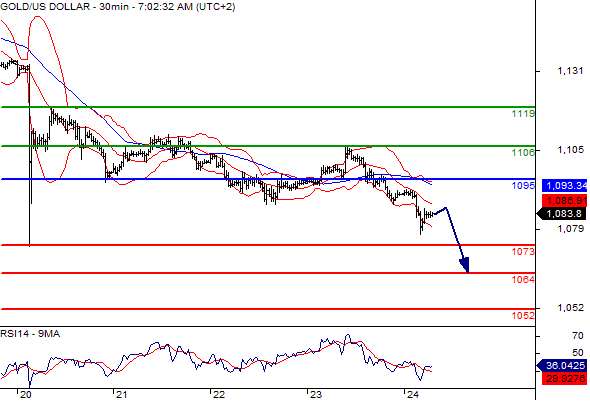

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.299

Likely scenario: Long positions above 1.299 with targets @ 1.3055 & 1.309 in extension.

Alternative scenario: Below 1.299 look for further downside with 1.295 & 1.2915 as targets.

Comment: The RSI is mixed to bullish.

USDCHF

Pivot: 0.9555

Likely scenario: Long positions above 0.9555 with targets @ 0.9625 & 0.965 in extension.

Alternative scenario: Below 0.9555 look for further downside with 0.9535 & 0.9505 as targets.

Comment: The RSI is well directed.

OIL

Pivot: 49.7

Likely scenario: Short positions below 49.7 with targets @ 47.5 & 47 in extension.

Alternative scenario: Above 49.7 look for further upside with 50.6 & 51.4 as targets.

Comment: As long as 49.7 is resistance, likely decline to 47.5.

DAX

Pivot: 11400

Our preference: Long positions above 11400 with targets @ 11550 & 11650 in extension.

Alternative scenario: Below 11400 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is mixed to bullish.