Daily Outlook Monday 27th July 2015

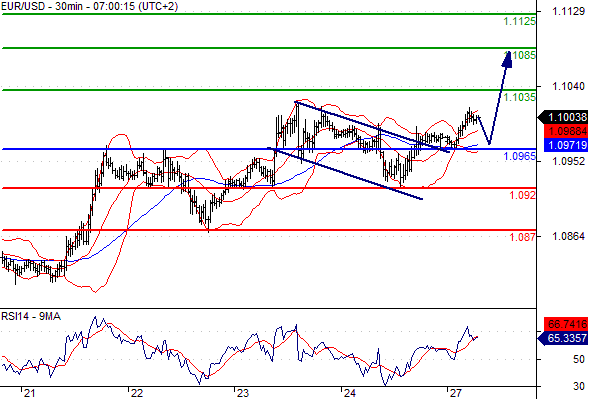

Gold recovered slightly today, hovering around the 1100 level. Crude oil is trading slightly under $48. EURUSD is broadly higher following last week’s recovery following the negative US New home Sales data which slipped to the lowest level of 2015, which is also the main reason for the USD weakness we noticed from Friday onwards

Global equities ended last week down, as the commodity bear market continued and the Chinese manufacturing PMI surprised to the downside raising concerns about a significantly weaker Chinese economy. European equities also suffered from weaker-than-expected Eurozone PMIs possibly reflecting Grexit fears. Asian equities continue to be lower into the week.

Looking ahead, Germany will release IFO Business Climate index. In the US, the June figures for durable goods orders are due for release. Focus this week will primarily be on Wednesday’s FOMC meeting, the rhetoric is expected to turn more hawkish amid the recent significant improvement in US economic figures and with international risk factors (Grexit) diminished.

Trading Quote of the Day: “If you are not willing to learn, no one can help you, if you are determined to learn, no one can stop you”

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.301

Likely scenario: Long positions above 1.301 with targets @ 1.307 & 1.3095 in extension.

Alternative scenario: Below 1.301 look for further downside with 1.298 & 1.295 as targets.

Comment: A support base at 1.301 has formed and has allowed for a temporary stabilisation.

USDCHF

Pivot: 0.9585

Likely scenario: Long positions above 0.9585 with targets @ 0.9635 & 0.965 in extension.

Alternative scenario: Below 0.9585 look for further downside with 0.9555 & 0.9535 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

OIL

Pivot: 49.1

Likely scenario: Short positions below 49.1 with targets @ 47.5 & 47 in extension.

Alternative scenario: Above 49.1 look for further upside with 49.6 & 50.6 as targets.

Comment: As long as 49.1 is resistance, likely decline to 47.5.

DAX

Pivot: 11550

Likely scenario: Short positions below 11550 with targets @ 11250 & 11150 in extension.

Alternative scenario: Above 11550 look for further upside with 11650 & 11720 as targets.

Comment: The RSI is bearish and calls for further downside.