For the first time this year the Fed raised interest rates and the market promptly sold off.

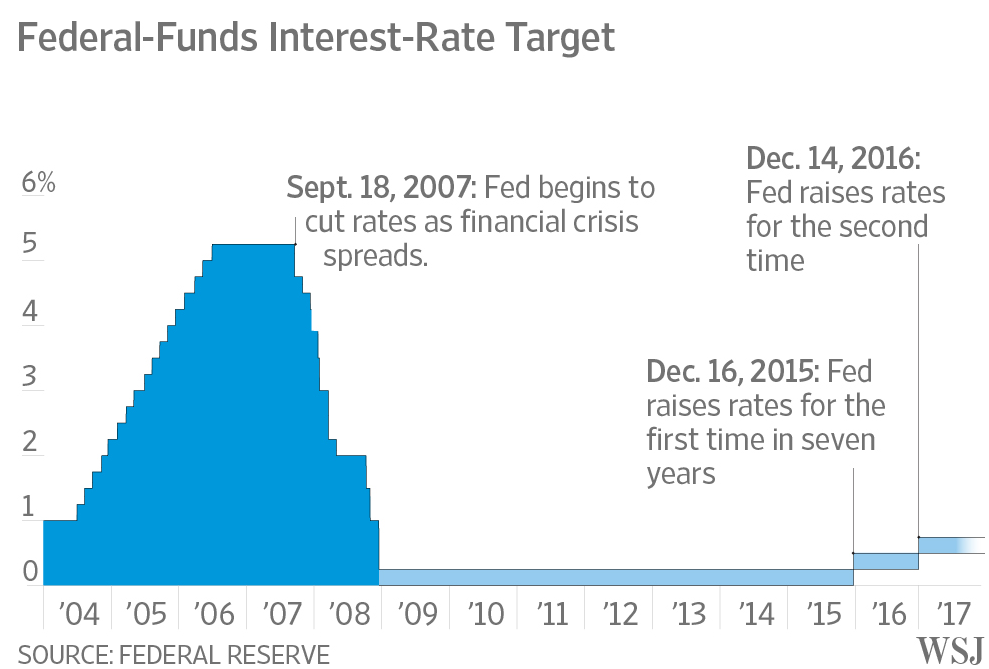

The Fed raised it’s benchmark interest rate 25 basis points, only the second hike in nearly a decade, and indicated that it might hike three more times in 2017. The Fed signaled confidence in the economy saying inflation expectations have increased “considerably” and suggesting the labor market is tightening, although it’s long term outlook for GDP growth is expected to be around 1.8% over the next few years.

According to the projection of 17 officials, the Fed expect the fed-funds rate to be 1.4% by the end of 2017, 2.1% at the end of 2018 and 2.9% in 2019. That indicates three quarter-percentage-point interest-rate increases each year for the next three years. An increase greater than what was projected back in September by Fed officials when they only saw two rate increases next year.

As a result the dollar rallied, while Treasury yields spiked. The greenback climbed to its highest level in 10 months versus the yen to 117.04 and advanced against most of its major peers.

In equities, the Dow fell 118.68 points, or 0.6%, to 19792.53, its biggest daily decline since Oct. 11. The S&P 500 lost 18.44 points, or 0.8%, to 2253.28, also its worst day since Oct. 11, and the Nasdaq Composite lost 27.16 points, or 0.5%, to 5436.67.

Crude for January delivery slumped 20 cents, halting a four-day rally to settle at $50.84 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell a $1.82 to $53.90 on London’s ICE Futures Exchange amid the dollar’s gains.

Gold for immediate delivery fell 1.4 percent to $1,142.95 an ounce, its lowest level since February and the Bloomberg Commodity Index dropped 0.3 percent as futures on sugar, cotton and soybeans fell by at least 0.4 percent.