After a three day sell-off, the greenback firmed last night despite mixed data out of the U.S. Existing home sales fell for the month of December to 5.49 million units from the previous month number of 5.65 million. Flash Manufacturing PMI however, was slightly better at 55.1 for the month of January compared to the previous month of 54.3 in December.

The dollar was stronger against the British Pound after the UK Supreme Court ruled that approval is required from the Parliament, in order to trigger Article 50 of the Lisbon Treaty. As a result of the ruling the pound fell to an overnight low of 1.2418 against the greenback.

Meanwhile the AUD tested 0.76 against the greenback and the CAD rose after President Trump took steps to revive the Keystone XL and Dakota access pipelines.

Oil prices edged higher overnight with WTI rising 0.8 percent or 43 cents to close at $53.18 a barrel in New York, the highest close since Jan. 6. Brent, the global benchmark, rose 0.4% or 21 cents to $55.44 a barrel on news that Iraq is close to implementing its share of pledged output curbs as per the OPEC agreement to trim bloated global inventories. Iraq’s oil minister reported that the country has cut production by 180,000 barrels a day.

The oil rally appears to have stalled amid concerns that oil shale producers in the US will increase production and hence offset the cut from OPEC producers as oil prices trade between $50 to $60 a barrel. On Friday, data from Baker Hughes showed the number of rigs in the U.S. rose by 29 to a total of 551 in the week ending Jan. 20. It was the biggest one-week increase in nearly four years.

After reaching a two month high on Monday, gold for February delivery closed down 0.4% at $1,210.80 a troy ounce on the Comex division of the New York Mercantile Exchange. Despite the drop in price, gold is up more than 5% on the year.

Silver for March delivery was up unchanged at $17.18 a troy ounce, April platinum rose 2.9% to $1,007.80 a troy ounce, and March palladium was up 3.2% at $795.85 a troy ounce.

In equities, the Dow rose 0.6% or 113 points to 19913, once again coming within 100 points of the never-before-reached 20000 level. The rise was attributed by some analyst, to comments by President Trump calling for a streamlining of the permit process for infrastructure projects, expediting environmental reviews for manufacturers and calls for pipelines built in the U.S. to be built using U.S.-produced steel.

The S&P 500 rose 0.7% to close at 2280.07 while the Nasdaq Composite added 0.9% to close at 5600.96, both indexes notching fresh closing records.

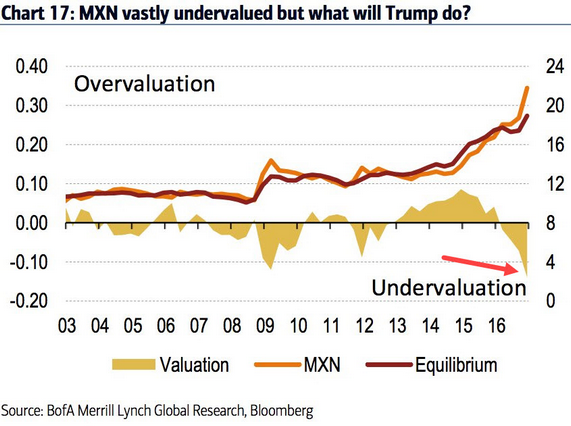

Chart of the Day.

The Mexican peso appears to be significantly undervalued at this point given that the NAFTA “renegotiations” is looming.