U.S. uncertainty on the Trump administration’s policy on trade and immigration coupled with an event laden week ahead, saw traders sell the greenback overnight. The yen climbed 1.3 percent to 113.675 per dollar while the Mexican peso strengthened 0.5 percent to 20.7771.

Amid widespread protest and congressional concerns within his own party, President Trump dried to defend his actions. However, despite this, many traders have begun to worry about the more controversial aspects of his agenda.

Traders were also waiting on U.S. manufacturing data and the conclusion of the Federal Reserve’s monetary policy meeting on Wednesday. Additionally on Friday, the Labor Department will report January employment numbers.

The euro was relatively flat at $1.06950 as was the pound at 1.2488.

In equities, global stocks retreated from recent highs as the market appeared to rebuke the new administrations policy preferences. The FTSE100 was down nearly 1 percent to 7118.48, the DAX down 1.1 percent to 11681.89 while the Dow closed below the 20000 mark to 19971.13. Focus appears to have moved from tax cuts, stimulus and an optimistic 4 percent GDP growth to what is perceived as the administration fixation on protectionist policy.

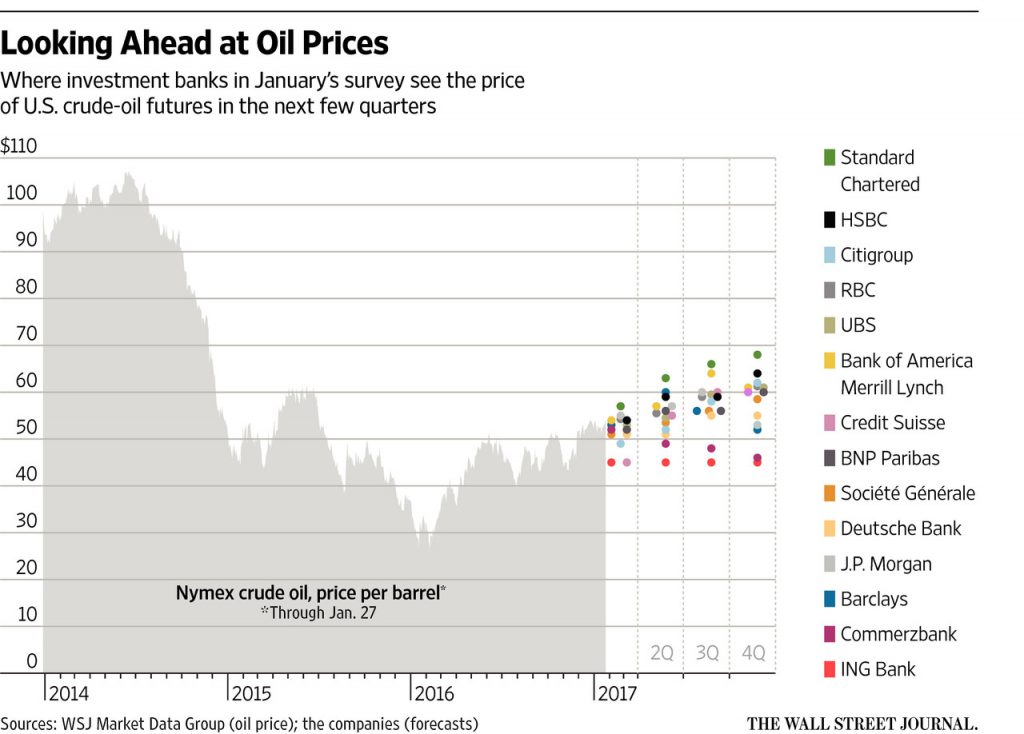

Oil prices also fell last night due to indications that U.S. shale producers are ramping up production. Baker Hughes Inc. reported Friday another rise in shale-oil drilling rigs in the U.S. According to the U.S. Energy Information Administration, U.S. oil production now stands at 8.96 million barrels a day.

U.S. crude for March delivery fell 1% or 54 cents to $52.63 a barrel on the New York Mercantile Exchange. While Brent, the global benchmark, fell 0.5% or 29 cents to $55.23 a barrel on London’s ICE Futures Exchange.

The weakening greenback saw the gold price rise last night ending a four day losing streak. Gold for April delivery settled up 0.4% at $1,196.00 a troy ounce on the Comex division of the New York Mercantile Exchange.

Chart of the Day