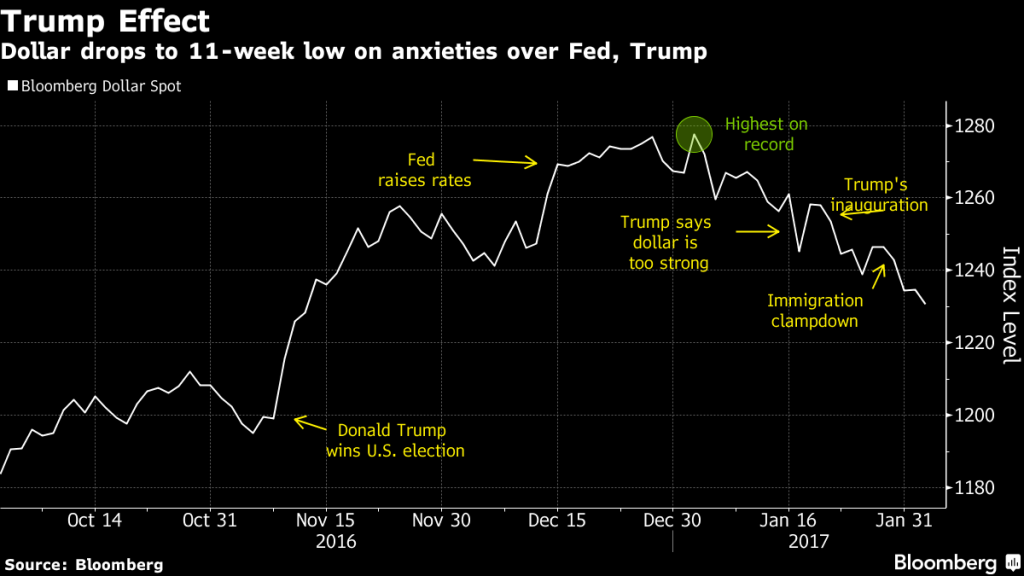

Fears as to whether the Trump Administration will prioritize tax cuts and boost fiscal spending, saw the U.S. dollar fall to two month lows across major currencies.

Dollar Yen fell 0.6 percent to 112.56 after reaching a session low of 112.48. At this stage it appears to be trading a range between 112-114 into the weekend.

The Australian dollar jumped 0.8 percent to 0.7645 after reaching a high of 0.7652 and breaking resistance at 0.7600. The next key level of resistance is at 0.7689 which is the November 8 low. The AUD spiked on the December headline trade balance result of A$3.51b versus estimated A$2.0b due to elevated commodity prices.

The Euro also strengthened 0.1 percent to $1.0764 against the greenback while the British Pound weakened 1 percent after forecast for price growth was not as aggressive as analysts expected. The pound also fell after the Bank of England said that there was more slack in the economy than previously thought.

Gold reached a two month high overnight boosted by a lower U.S. Dollar.

Gold for April delivery settled up 0.9% at $1,219.40 a troy ounce on the Comex division of the New York Mercantile Exchange after touching $1,227.50, the highest for a most-active contract since Nov. 17.

Concerns over comments by President Trump and National Security Adviser Mike Flynn, that Iran was “on notice” following its ballistic missile test also help push the gold higher.

Crude-oil futures fell overnight as investors weighed signs of falling production and rising inventories.

WTI fell 0.63% or 34 cents to $53.54 a barrel on the New York Mercantile Exchange. Brent, the global benchmark fell 0.42% or 24 cents to $56.56 a barrel on ICE Futures Europe.

The market was mostly higher in the morning extending gains from Wednesday but fell on Producer selling to cap gains in the price.

Chart of the Day