The greenback edged higher on Monday as traders gain confidence that the Federal Reserve will raise rates this month. All eyes are now on NFP numbers which will be released on Friday. A strong report will solidify expectation of a rate increase. However, the yield curve would suggest some caution on policy/economy despite the Feds optimism.

According to CME Group data, Fed-funds futures show an 86% chance that the Fed will raise rates at the March meeting and a 53% chance that there will be a further three or more rates rises this year.

The Euro declined with the shift in interest rate focus and concerns over the future Dutch and French elections. Former French PM Allain Juppe stood aside overnight and ruled out replacing the centre right candidate, Francois Fillon who is currently embroiled in scandal. The decision enhances nationalist Marine Le Pen position with traders now concerned about a similar Brexit or Trump style event.

The JPY strengthened against the greenback after North Korean launched three intercontinental missiles which fell into the sea inside Japan’s exclusive economic zone.

In Australia, we expect the AUD to trade around current levels ahead of the RBA statement today. The stronger USD should see upside resistance at 0.7620 with support at 0.7570. Given the firm tone form the U.S. we would expect selling on any rallies.

U.S. equities fell on Monday with financial stocks leading the retreat from last week’s highs.

The Dow Jones Industrial Average has fallen approximately 150 points since Wednesday when investor optimism about the U.S. economy saw the Blue Chip index breach 21000 for the first time.

The Dow fell 0.2% or 51 points to 20954. The S&P 500 lost 0.3% to 2375 and the Nasdaq slid 0.4% to 5849.

In energy, oil prices edged lower Monday as investors continued to weigh OPEC’s production cuts against rising production in the U.S.

WTI futures fell 0.24% or 13 cents to $53.20 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, gained 0.2% or 11 cents to $56.01 a barrel on ICE Futures Europe.

Gold futures slumped 0.1 percent to settle at $1,225.50 an ounce in New York for a fifth day of losses. That’s the longest slump since November. While according to bourse data released on Monday, Copper futures tumbled 1.6 percent after the market saw the biggest inflow of the metal in 15 years to warehouses managed by the London Metal Exchange.

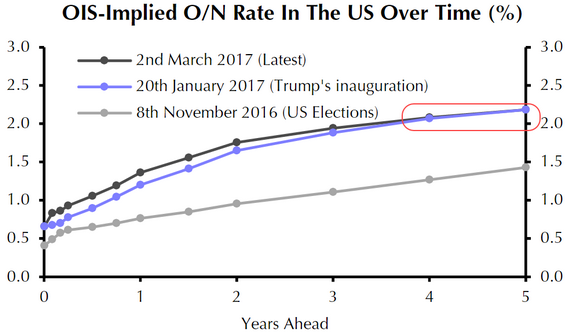

Chart of the Day.

While the markets have accepted higher Fed Funds rates over the next couple of years, longer-dated rate expectations have not budged since January 20th. This would seem to suggest that while a near-term boost in growth (and inflation) is likely, confidence in long-term economic expansion remains muted.

Source: Capital Economics