Yesterday as expected, the Reserve Bank of Australia kept it’s cash rate unchanged at 1.50%. In the accompanying statement, the RBA remained positive around global growth but expected inflation to remain low for some time. We would expect that the RBA will not make any further moves on the downside for the rest of the year. The AUD saw an intraday high of 0.7633 but fell as traders looked to the forthcoming FOMC meeting on March 15.

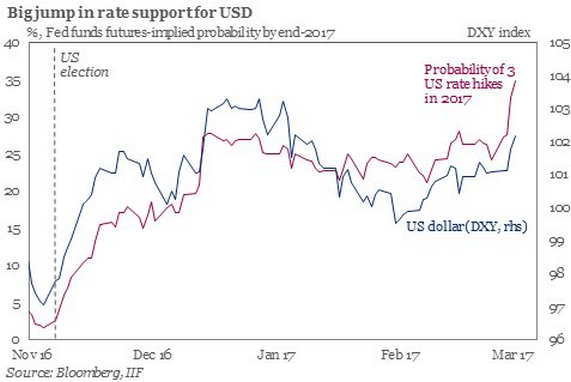

Overnight the greenback strengthened supported by expectations that U.S. interest rates will rise this month. The dollar rose against its major peers including the Euro and Japanese Yen but fell against most emerging-market currencies.

Speeches last week by several FOMC members would seem to indicate that if data remains strong, including Friday’s non-farm payroll report, then you could expect that the Fed will raise rates next week.

In other currencies, the Chinese yuan remained relatively unchanged against the dollar after data showed that for the first time in eight months, China’s foreign-exchange reserves rose. The surprise increase was driven by Beijing’s effort to stop money leaving its shores, as well as valuation changes in the stockpile’s assets.

In equities, the Dow Jones Industrial Average slipped 0.1% or 30 points to 20925. The S&P 500 eased 0.3% to 2368 capping its first two day slide since January, while the Nasdaq Composite fell 0.3% to 5834.

There was very little on the earnings and economic calendar so traders are focused on upcoming central bank meetings. The European Central Bank will conclude its monetary policy meeting on Thursday with focus on whether they will taper its €2.3 trillion bond-purchase program.

The Stoxx Europe 600 fell 0.3%, on track for a fourth session of losses.

In commodities, copper fell for a fourth day as stockpiles in warehouses tracked by the London Metal Exchange jumped 33 percent on two days, the most since 2004.

Chart of the Day.

With the March hike almost a certainty, market participants have turned their attention to the Fed policy for the remainder of the year. The probability of three hikes in 2017 has risen significantly but remains below 40%.