The Aussie moved higher overnight on the back of a weaker greenback following last weeks dovish FOMC meeting.

The currency moved through 0.77 cents hitting an intraday high of 0.7746 before finally settling around technical support of 0.7730 which was the November peak.

Attention now turns to today’s RBA minutes for further guidance as to the Board’s view on housing and the switch from full-time to part-time employment and how that pertains to underemployment. One would expect that this risk remains to the upside.

In Europe, the Euro fell from 1.0777 to 1.0725 despite comments from ECB Governor Visco that the central bank could step away from its commitment to keep interest rates low for a long time after quantitative easing stops.

The British Pound fell from 1.2435 to 1.2335 fell on news that Prime Minister Theresa May is planning to trigger Article 50 on March 29. According to Irish Prime Minister Edna Kenny, the negotiations could turn “vicious.” since both the EU and the U.K. will have to determine what is and isn’t negotiable.

In equities, the S&P 500 fell 0.2% to 2373 while the Dow Jones Industrial Average fell 0.04% to 20906. The Nasdaq rose 0.01% to 5902.

The Stoxx Europe 600 Index dropped 0.2 percent, with oil and gas companies down 0.9 percent while the MSCI Emerging Market Index added 0.7 percent, headed for a seventh straight gain in its longest run since August.

In commodities cocoa futures soared 5 percent, marking the largest one-day gain in five years as traders added to bullish positions over concerns about cocoa supplies.

New York cocoa for May delivery settled at $2,116 a tonne on the ICE Futures exchange.

Reports of poor cocoa bean quality in the Ivory Coast and other African growing countries as well as forecasts of a returning El Niño, ignited the price rise.

In other markets, raw sugar for May delivery fell 2.6% to settle at 17.70 cents a pound, arabica coffee for May added 2.3% to close at $1.4525 a pound, and May cotton shed 1.3% to end at 77.33 cents a pound.

Chart of the Day

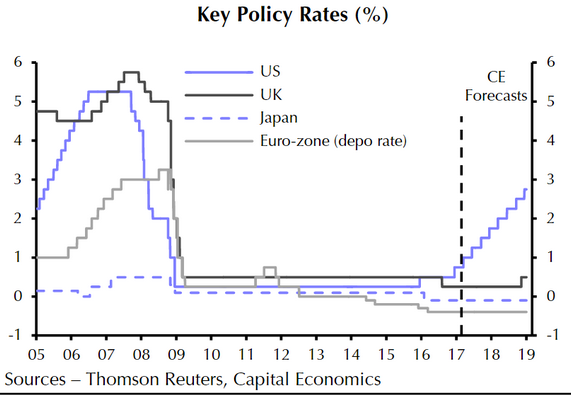

Capital Economics sees the Fed getting close to a 3% fed funds rate over the next couple of years. However, a hike in the UK is not expected until late next year, while the ECB and the BoJ will stand pat on rates.