The Reserve Bank of Australia left interest rates on hold as expected. In the policy statement, Governor Philip Lowe again expressed concerns over the level of household debt which would indicate that rates will unlikely head lower unless a shock to the economy occurs. The Aussie rallied to an intraday high of 0.7556 before settling back to lie just 10 points higher then where it opened yesterday.

Attention now turns to tonight’s Monetary Policy Statement from the U.S. Federal Reserve which is also expected to remain on hold. The March hike was well telegraphed so expectation is that the next move will be in June.

Aussie should remain capped at 0.7600 and expectation is for weakness over the next few months as softer commodity prices, higher U.S. yields and President’s Trump’s protectionist stance providing strong resistance.

The Kiwi rose yesterday on the back of strong employment data. New Zealand’s jobless rate fell to 4.9 percent from 5.2 percent last quarter as payrolls climbed more than forecast. This coupled with strong dairy prices should see the Kiwi push higher to the 0.7000 level.

In commodity news, Gold traded little changed at $1,256.85, while copper futures declined 0.3 percent.

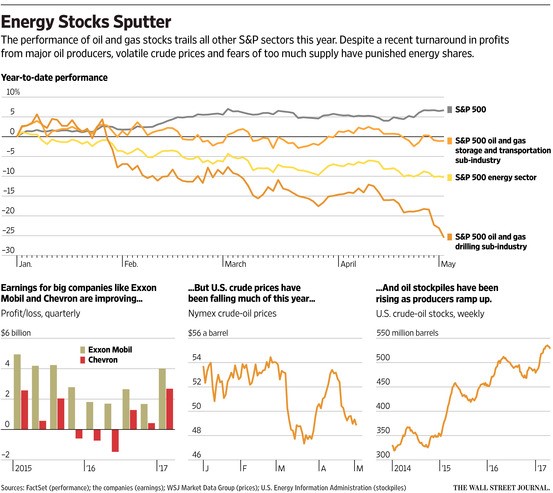

Oil rose 0.9 percent following Tuesday’s 2.4 percent decline. Crude had dropped to the lowest level in more than a month on concerns about rebounding output from Libya and oversupply in the U.S. pushing prices to new lows.

Chart of the Day.