Daily Outlook Tuesday 21st July 2015

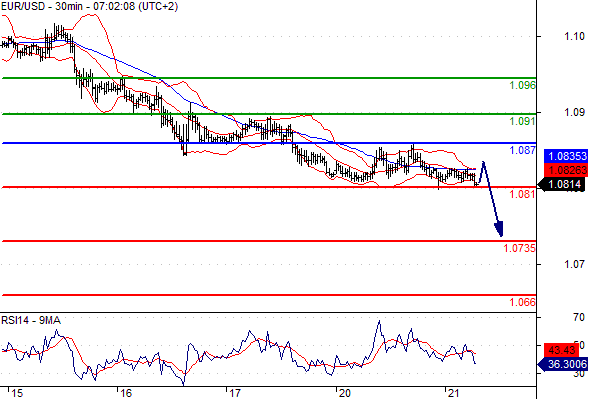

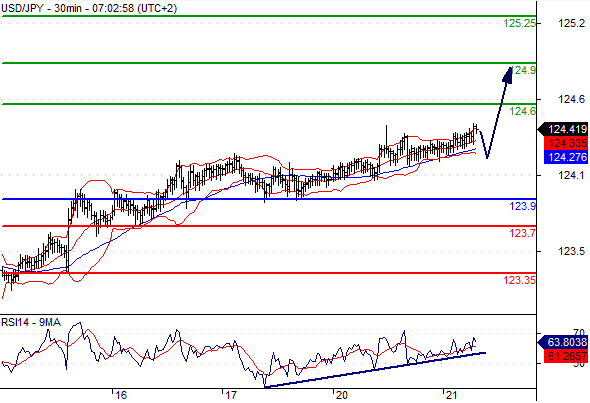

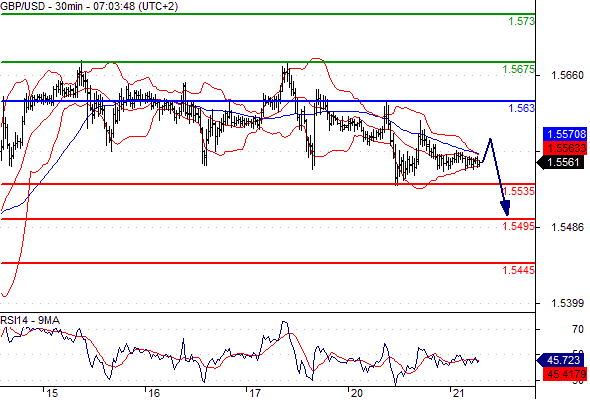

USD bullish tone remains unchanged today in a quiet market so far. View that the Fed will increase rates in September (50% chance) and relatively soft data out of EU (German PPI index fell by 1.4% in June compared to a year before) helped maintain the demand for the greenback at high levels.

Strong USD is also cited as a reason for the drop in commodity prices with gold hovering around 1100 after diving to a 5 year low yesterday. Crude oil also broke $50 and is now hovering around that level. Commodities index is now trading at its lowest since 15 years. A better retail sales and NFP report will likely push the probability of the fed rate hike to over 50% in the coming month, increasing the chances of 1.05 EURUSD further, Nomura bank cites.

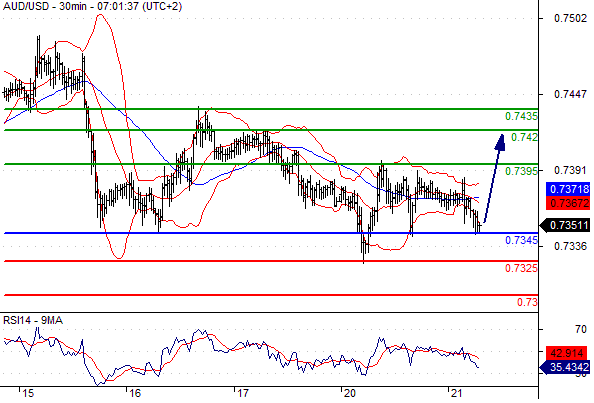

AUDUSD is weak following the bearish RBA minutes who pointed that employment is still fragile and growth is subdued in the prior quarter. Commodity price drop and slowdown in china is attributing to speculation that the RBA might soon cut rates again. Bank of Canada already cut rates last week, and another rate cut from New Zealand is likely going to weigh on the AUD further.

Noteworthy is USDJPY one month high at 124.48 as well as 1 month low EURUSD at 1.0807.

Trading Quote of the day: “The open belongs to the amateurs and the close belongs to the professionals”

Green lines are resistance, Red lines are support

USDCAD

Pivot: 1.2945

Likely scenario: Long positions above 1.2945 with targets @ 1.3045 & 1.309 in extension.

Alternative scenario: Below 1.2945 look for further downside with 1.29 & 1.281 as targets.

Comment: The RSI is well directed.

USDCHF

Pivot: 0.958

Likely scenario: Long positions above 0.958 with targets @ 0.9655 & 0.968 in extension.

Alternative scenario: Below 0.958 look for further downside with 0.955 & 0.9505 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

OIL

Pivot: 51.25

Likely scenario: Short positions below 51.25 with targets @ 49.3 & 48.75 in extension.

Alternative scenario: Above 51.25 look for further upside with 52.2 & 52.85 as targets.

Comment: As long as 51.25 is resistance, likely decline to 49.3.

DAX

Pivot: 11475

Likely scenario: Long positions above 11475 with targets @ 11800 & 11900 in extension.

Alternative scenario: Below 11475 look for further downside with 11250 & 11150 as targets.

Comment: The RSI is mixed to bullish.