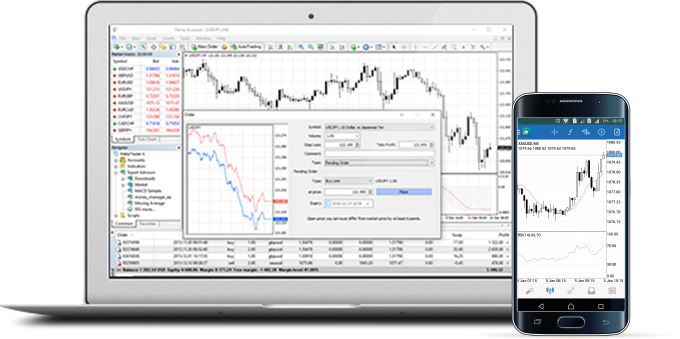

A combination of the well-renowned MT4 platform features, but with easyMarkets trading conditions. Enjoy negative balance protection and fixed spreads, which come together to give you the perfect setup for your trading needs.

What is MetaTrader 4 (MT4)?

MT4 is a well known trading platform used widely amongst traders on account of its ability to provide its users with automated trading, and a tailored market analysis through a multitude of features.

Why use MetaTrader 4 (MT4)?

The vast amount of information displayed by MT4 provides it with the status of the preferred trading platform by advanced traders. The information it displays is greatly customized; with movable windows and a changeable interface, such as overlays and technical indicators.

easyMarkets MetaTrader 4 (MT4) Features

One Click Trading

Pre-installed Indicators and analysis tools

The ability to customize trading templates to suit your needs, or select from a range of pre-designed templates.

Access to a 20 year archive of data, so you can back-test your expert advisors.

The ability to choose from a range of order types, including Market orders and Pending orders.

easyMarkets Conditions on MetaTrader 4 (MT4)

275+ markets including currencies, metals, commodities, indices, shares and cryptocurrencies.

Account base currencies available: USD, GBP, EUR, CAD, AUD, ILS, CNY, NZD, NOK, CHF, JPY, PLN, SGD, ZAR

Margin Call when Equity / Used Margin = 70%

Deal Stop Out when Equity / Used Margin = 30%

All Expert Advisors allowed

Price transparency through fixed spreads.

easyMarkets MetaTrader 4 (MT4) Order Types

easyMarkets guarantees no dealer intervention, irrespective of what type of order you place. Our pride in being a market maker gives us reason to keep fixed spreads, and even despite the volatility of the markets, never disable trading.

Order types

Market Orders

The most straight forward type of order, this opens a trade – place buy or sell orders at the current market price.

Pending Orders

This type of order allows you to buy or sell at a pre-determined price in the future. Pending orders can be:

Buy Stop – Set the price you would like your position to open at. This type of order can be used when the current price is lower than the value you set. This is used when the client thinks the price will reach a certain level and continue increasing.

Sell Stop – Much like buy stops, this allows you to open a position at a predetermined price level. The difference is the price is currently higher than the value you set. This is used when the client assumes the price will reach a level and continue falling.

Buy Limit – When your instrument’s price reaches the level you set, a buy order will be performed. This is used when the price is falling, and it is assumed it will reach a price and increase.

Sell Limit – This opens a sell order when the instrument’s price reaches the level you set. This is used when it is assumed the price after increasing will reach a level and then reverse and drop.